“It has been raining money on fools for too long”

Elon Musk, CEO, Tesla Motors

While many will instinctively feel that people in glass houses shouldn’t throw stones (Tesla – Musk’s company has been the beneficiary of massive subsidies) there is more than a kernel of truth in the above quote. We have reached a notable juncture in global capital markets that has important and widespread implications.

Policy and inflation

For years the authorities have pursued aggressive, experimental monetary and latterly fiscal policy in an effort to support the economy via markets. Like so many quasi-governmental programs, what started out as a temporary measure to stave off the effects of the global financial crisis in 2008 became something that, once put in place, is hard to remove. The basic premise was that by supporting asset prices the authorities could encourage greater levels of activity and consumption in the real economy.

The policy could be prosecuted with abandon so long as inflation did not appear. Owing to a number of structural factors (the now familiar debt, demographics, global competition and technological disruption) inflation remained subdued allowing asset prices to reach ever-greater levels of valuation. The immediate effects all seemed to be good. Markets rose, economies expanded and the stock of the Central Bankers, at least in their own eyes, sky-rocketed. The longer term effects, harder to see but more pernicious, were either ignored being considered unimportant or to be dealt with another day.

Thus the structural build up in debts, the resultant inequality driven between asset owners and others and the fragility of capital markets created by over-valuation were allowed to become embedded. All of this now appears to be changing.

Trouble comes in threes

There are broadly three separate influences which have taken place over different time frames but which are coming together in an unfortunate confluence of events.

First is the shocking humanitarian disaster unfolding in Ukraine. As we wrote in our factsheet in February, this is a reminder that geopolitical risk is ever-present and has a nasty habit of flaring up unexpectedly. Further, such occurrences are impossible to forecast and should not influence portfolios unduly.

That does not mean it is without consequence. The war has put upward pressure on commodity.

prices, notably on oil and gas as well as food. Europe is especially affected by the rise in the price of gas on which it is dependent, whereas food prices hit the poorest countries and lower income groups hardest. Further it is more evidence that the global rules based international system under the auspices of the Pax Americana is fraying. The splitting of the world into two separate spheres of influence centred on the US and China has taken another step forward. In aggregate this will raise uncertainty and risk premia, create more inflation in the short term but make a recession more likely.

The second event is the ongoing distortions wrought by COVID and the governmental policy response. Although the worst of the pandemic is hopefully now in the past we are still living with the consequences. The world economy has never been voluntarily shut down before and we are learning that turning it back on is complicated. As we are discovering consumption, rather than simply stopping, switched from services to goods and is now in the process of switching back again. This recovery in demand is pulling on disrupted supply chains leading to rising prices.

This matters not just because it erodes consumer purchasing power and makes real returns harder to achieve but also because of the degree to which all capital markets are on the thrall of policy. We can debate the merits of this policy approach but it is hard to think it has not had a profound effect on capital allocation by influencing asset prices.

This dynamic reached its zenith at the March 2020 low where the authorities, terrified by unfolding pandemic, increased support (both monetary and fiscal) in a way that they probably knew was unwise – reckless even – but did not think they had any choice. The result was a speculative period in markets that was to us reminiscent of the 2000 technology boom. This is not because today’s technology companies share the same bubble-like attributes of low profitability and sky high valuations, but because in 2000 the “Y2K” problem scared the authorities into similarly reckless action driving a speculative peak. It looks awfully like February 2021 marks a similar top in markets, at least in the most speculative areas.

The combination of rising rates, a commodity price shock, a weakening fiscal impulse as well as the reversal of quantitative easing (QE) makes for a material tightening in financial conditions.

This brings us to the third overlapping event – the as yet uninterrupted credit cycle that started in 2008 and which now may be coming to an end. In a world where support for markets is less meaningful, where cashflows may become less bountiful and where businesses find themselves over-extended having made capital allocation decisions in an environment bathed in the elixir of QE, sound financing may become more important.

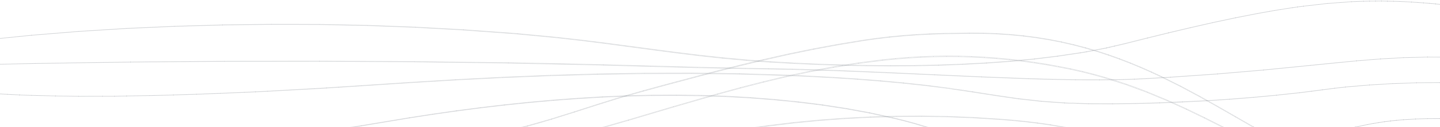

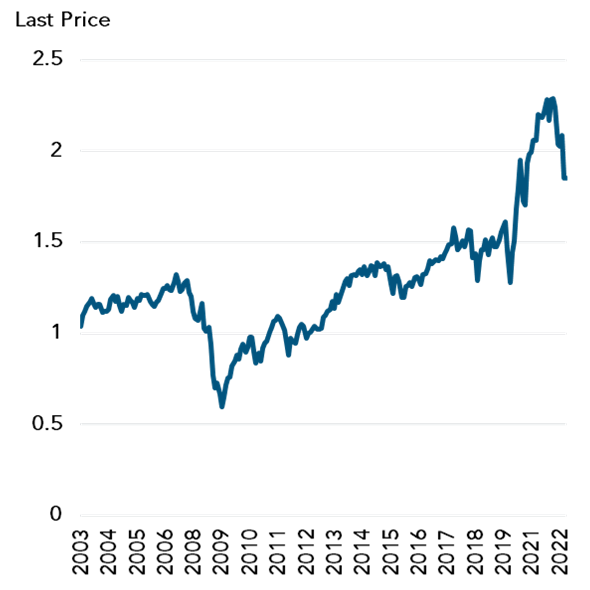

Figure 1: iShares iBoxx High Yield Corporate Bond ETF

Ukraine, COVID and a tightening policy environment making it more expensive for companies to raise finance therefore ushers in a more challenging time for asset markets.

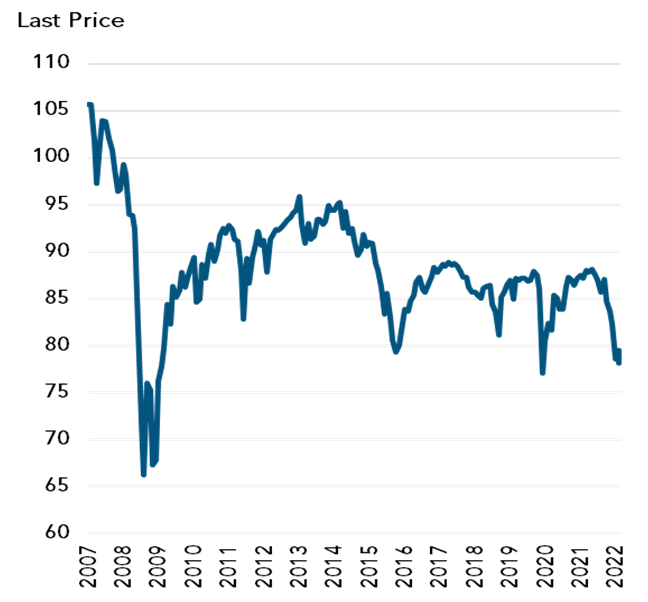

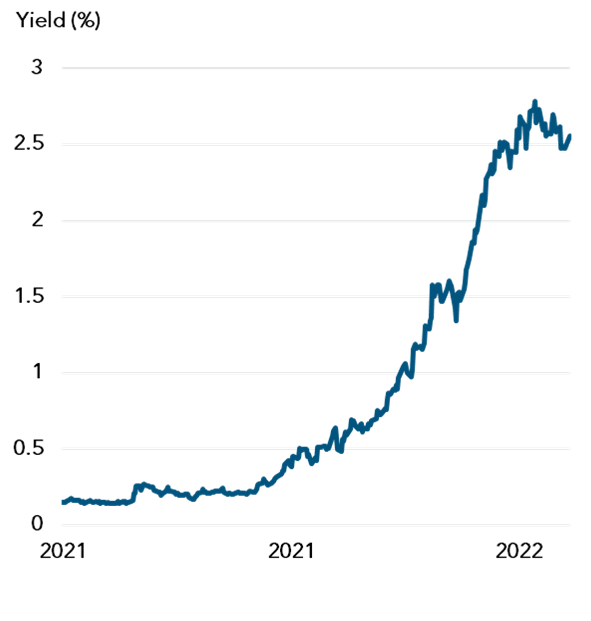

This confusing mix is evident in the bond market. While the US 2 year note has sold off aggressively – moving from 0.21% at end of August 2021 to 3.3% by mid-June 2022 (figure 2) – longer term rates have been less flighty. As such the yield curve1 as expressed by the difference between these rates (also called the 2-10 spread) has dramatically flattened and ultimately inverted (as shown in figure 3 with price moving below zero). This suggests the rate rises anticipated by the 2 year note may well precipitate a slowdown and possibly a recession.

The question is what do we do? The combination of elevated valuations and a tightening financial environment which may precipitate a recession make the outlook quite challenging for investors.

Figure 2: US 2 Year Treasury Note

Figure 3: US 2 year, 10 year spread

Further the existential and ongoing changes relating to the

febrile political environment driving debate towards the extreme, reduced cross border immigration and a renewed confidence in the efficacy of fiscal policy mean that even if cyclical inflation is peaking the longer run rate may settle at a higher level. It is possible that investors face the double blow of less supportive policy and a higher inflation hurdle rate when considering real (above the rate of inflation) capital and income growth.

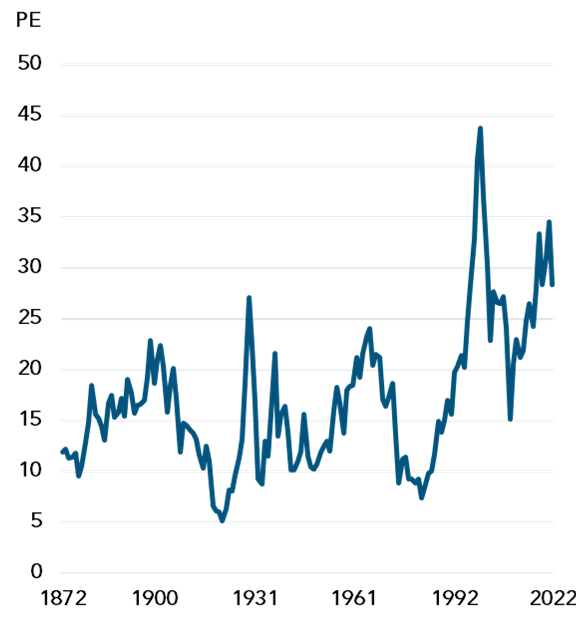

It is also worth noting that while the most speculative and highly valued assets have been severely impaired, the sell-off in the wider market is still unremarkable. As such the market remains fully valued (at, or near highs relative to history) on long term valuation measures (see Figures 4 and 5).

We still fear that investors have sought perfection within an imperfect framework in the sense that the market itself remains overvalued.

Figure 4: US Market Cap/GDP

Figure 5: Shiller PE Ratio by year for the S&P 500

The result has been valuation became ignored in favour of far off but less predictable profits. This is very characteristic of the late stages of a long market ascent.

The importance of income

As we have said before although the world is changing, the need for income does not change. Even more so real income for those with irreplaceable capital. However, we must make sure that the pursuit of income does not endanger long term capital unduly. This can be as a result of market shocks in the short term, inflation in the medium term and obsolete business models over all time periods. We do this by seeking the optimum balance of quality, income (or value) and growth.

Macro to micro

If the macro-economic implications of the above are profound the micro, company level, effects are equally important. Echoing Elon Musk’s comments, the era of free money is over. Freely available capital has incentivised business models that prioritised growth over profitability.

Such companies, certain that capital (both equity and debt) will be both plentiful and low cost have sought to claim as much of a market as possible to steal a march on their competitors. Profitability has been deferred in favour of expanding to fill a total addressable market (think Carvana, Uber, Deliveroo). The problem with this strategy arises when conditions become less favourable both economically and in terms of the cost of capital, and these business models can be revealed to be built on sand.

Troy’s approach of emphasising quality allows us to navigate these more difficult waters with confidence. Further, the discipline of the need to generate income ensures that valuation remains an important part of our process for managing the fund.

Our focus on quality ensures that our companies possess identifiable competitive advantages. This is evidenced in high and sustainable returns on capital and attractive margin structures. As a result our businesses tend to have a one-way relationship in capital markets. By this we mean that they generate sufficient cash flow to be self-financing. They can choose to use capital markets to support operations or aid capital allocation but are not beholden to the need for continuous financing.

This matters because in more challenging times those companies that possess these qualities are more resilient both to a less favourable economic environment as well as inflation. A lack of required capital constrains the actions of others and allows the quality incumbents to shine as cheap-capital empowered competition recedes. Further the same qualities that allow for high returns on capital give companies the ability to raise prices without unduly effecting demand. We have seen this pricing power demonstrated in recent results across our portfolio.

None of the above is new but at times of speculative excess, which is descriptive of recent times, these well-established principles can easily be forgotten. Recent events suggest investors are re-learning them once again.

Conclusion

Our portfolio characteristics and valuation are shown below. Following from the above, the combination of quality and value should be logical. We have businesses that should be able to operate in a robust manner in an environment when others may fall by the wayside.

This gives us confidence in the outlook for the free cash flow the portfolio will generate. Further the value embedded in our fund should allow us to continue to produce decent returns balanced between income and capital despite the change in the backdrop that investors and companies are experiencing.

James Harries

20th June 2022

Disclaimer

All information in this document is correct as at 31 May 2022 unless stated otherwise. Please refer to Troy’s Glossary of Investment terms here .Past performance is not a guide to future performance. Forecasts are not a reliable indicator of future performance. The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party. Benchmarks are used for comparative purposes only.

Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. Any decision to invest should be based on information contained in the prospectus, the relevant key investor information document and the latest report and accounts. The investment policy and process of the fund(s) may not be suitable for all investors. If you are in any doubt about whether the fund(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Asset allocation and holdings within the fund may be subject to change. Investments in emerging markets are higher risk and potentially more volatile than those in developed markets.

The fund(s) of Trojan Investment Funds are registered for distribution to the public in the UK but not in any other jurisdiction.

The distribution of shares of sub-funds of Trojan Investment Fund (“Shares”) in Switzerland is made exclusively to, and directed at, qualified investors (“Qualified Investors”), as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended, and its implementing ordinance. Qualified Investors can obtain the prospectus, the key investor information documents, or as the case may be the key information documents for Switzerland, the instrument of incorporation, the latest annual and semi-annual report, and further information free of charge from the representative in Switzerland: Carnegie Fund Services S.A., 11, rue du Général-Dufour, CH-1204 Geneva, Switzerland, web: www.carnegie-fund-services.ch. The Swiss paying agent is: Banque Cantonale de Genève, 17, quai de l’Ile, CH-1204 Geneva, Switzerland.

In Singapore, the offer or invitation to subscribe for or purchase Shares is an exempt offer made only: (i) to “institutional investors” pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore (the “Act”), (ii) to “relevant persons” pursuant to Section 305(1) of the Act, (iii) to persons who meet the requirements of an offer made pursuant to Section 305(2) of the Act, or (iv) pursuant to, and in accordance with the conditions of, other applicable exemption provisions of the Act. This document may not be provided to any other person in Singapore.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: Hill House, 1 Little New Street, London EC4A 3TR. Authorised and regulated by the Financial Conduct Authority (FRN: 195764).

Copyright Troy Asset Management Ltd 2022