As long as the music is playing, you’ve got to get up and dance. We’re still dancing

Chuck Prince, Citigroup CEO, July 2007

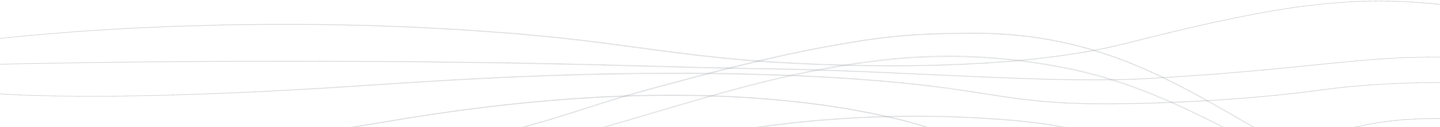

Investors may look back at history and see that recessions have often followed periods where the earnings yield on equities was low relative to central bank interest rates (Figure 1). Today the number is negative – earnings yields are below Federal Reserve interest rates, a phenomenon last observed just before the dot-com crash. For now, the equity market has shrugged off this ominous precedent to deliver a +8.9% gain for the MSCI World Index (in sterling) through the first six months of the year. This paper will explore who, or what, is moving the equity markets.

Figure 1 – US Equity Earnings Yield Premium to Fed Funds Rate

Past performance is not a guide to future performance.

Source: Bloomberg, S&P 500 earnings yield relative to Fed Funds Upper Rate, 30 June 2023.

Narrowness

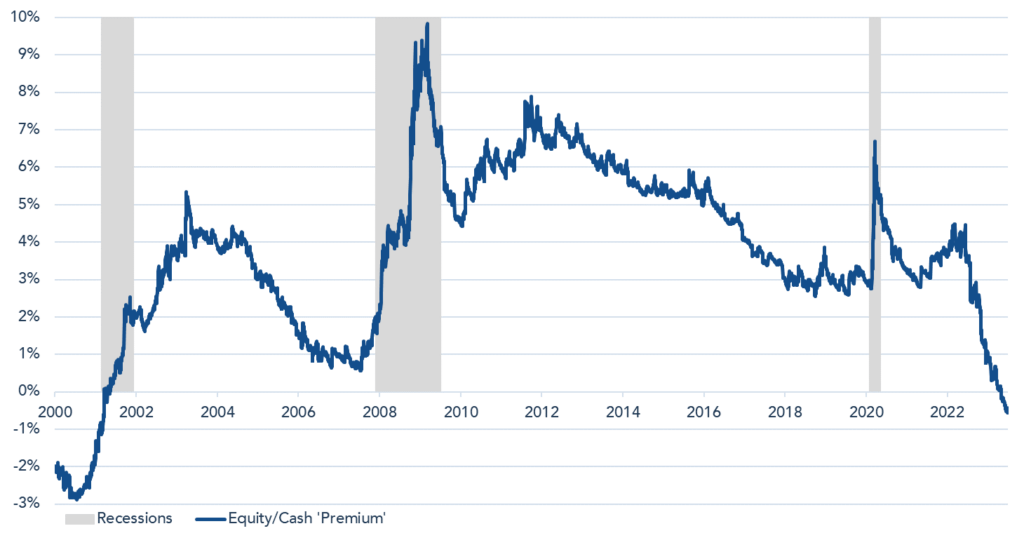

The MSCI World Index represents the largest companies in the world, with 1,544 constituents today, including UK stalwarts HSBC, Rolls Royce, and AstraZeneca. Despite its breadth, 77% of returns year-to-date have been driven by seven companies (Figure 2) representing only 16% of the index by weighting. Bernstein data suggest this ‘narrowness’ is amongst the most pronounced in the last 40 years.

Of the seven companies in Figure 2 that have driven returns this year, some are technology-related businesses that are seen as beneficiaries of generative artificial intelligence (AI). Whilst the use cases for generative AI are exciting and could be significant, it seems that the market today is paying up for potentially significant but uncertain future profits. The market’s fears of recession have also faded, while the risk of a downturn remains as interest rates move higher. Companies selling phones that cost as much as £1,700, or digital advertising to brands, will not be immune to economic weakness, regardless of whether generative AI improves their products. Performance concentration amongst a small number of companies, as we see today, creates a fragile market.

Figure 2 – MSCI World Net GBP 2023 Year-to-Date Return Breakdown

Past performance is not a guide to future performance.

Source: Troy Asset Management Limited, 30 June 2023. Reference to specific securities is not intended as a recommendation to purchase or sell any investment.

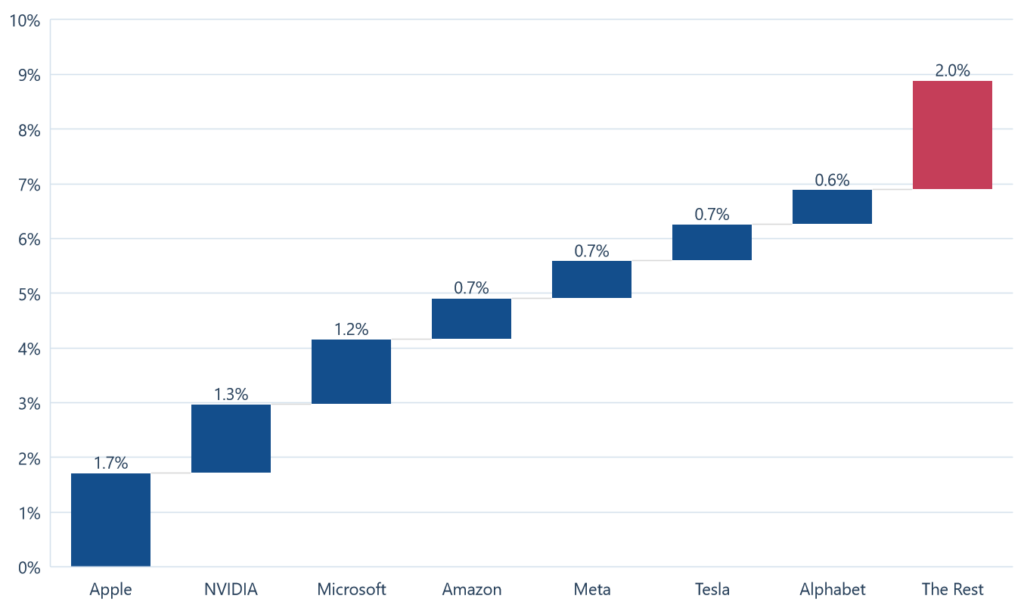

Valuation-insensitive buyers

Market narrowness itself is not a new phenomenon, a similar situation occurred in the second half of 1999. The difference today is that 33% of the US equity market is owned by valuation-insensitive buyers in the form of passive index funds and ETFs (Figure 3). These funds aim to track indices, each of which is made up of a group of companies, the inclusion of which is based on a set of pre-determined rules. Most popular indices weight companies based on their market capitalisation. The largest ETF today is the $419bn SPDR ETF that aims to replicate the return of S&P Global’s well known S&P 500 index.

Figure 3 – Index/Passive Share of US Equity Market

Past performance is not a guide to future performance.

Source: Alex Chinco and Marco Sammon study estimating passive share based on rebalance volumes, 31 December 2021.

In the scenario above, where share prices of a narrow group of companies rise – regardless of whether the move is justified or not – passive funds are forced to buy more of them. This is due to the narrow group of companies having a higher market capitalisation, meaning they represent a greater share of the index. Funds that track the index must then rebalance to reflect the new weightings. By definition, the index funds will be selling smaller, out-of-favour companies and buying into higher share prices by rebalancing towards the new, larger market capitalisations. Such behaviour adds fuel to the fire when valuations increase to unreasonable levels and likely extends market bubbles, both in scale and longevity.

Passive investing at its current scale is also untested through a prolonged recession. During the Global Financial Crisis, passive funds represented a fraction of the assets they hold today. It is worth remembering that a share price is set by its marginal buyer and seller; in recent years, this has often been a passive fund buying at any price. This relationship works in both directions and, if passive funds see redemptions, then they will also be selling at any price. Just as bubbles are extended in size and duration, downturns may also be drawn out and more severe.

The extremes are likely to intensify over time as passive asset management continues to take market share of savings. John Bogle, the founder of passive investing giant Vanguard, said in 2018, ‘It seems only a matter of time until index mutual funds cross the 50% mark. If that were to happen, the “Big Three”1 might own 30% or more of the U.S. stock market – effective control. I do not believe that such concentration would serve the national interest.’ History confirms that widespread use of rules-driven buying and selling should be treated with caution. New computer-driven ‘program trades’ were partially blamed by the Federal Reserve for causing the 19 October 1987 stock market crash where the equity market fell -20% in a single day. If passive’s share does move from 33% today to 50%, as Bogle hypothesises, it is possible that we may encounter similar volatility where ‘the market moves the market’, with passive selling exacerbating what would otherwise be a modest market decline.

Index Quirks

Passive investing can have unusual quirks that end-clients are unlikely to understand when they invest their savings in an index. For example, a popular passive fund that tracks the price-weighted Dow Jones Industrial Average Index has close to $30bn of assets. When Apple decided to split its stock 4:1 in 2020 its overall market value did not change, as each shareholder simply owned four times the number of shares each with a quarter of their previous value. However, the stock split resulted in six companies entering or exiting the Dow index as it attempted to rebalance for the new share price and created buying or selling pressure on these companies from a $30bn behemoth. It is probable that many underlying investors were not aware that Apple choosing to split its shares would result in their savings being moved from Exxon Mobil into biotech stock Amgen, or the software company Salesforce. These bizarre changes are almost impossible to predict, but are important to understand as research from the National Bureau of Economic Research suggests there can be a 5% impact on share prices as a stock is added to an index2. Decades ago, these changes would have come out in the wash, but when passive funds own 33% of the market they are bound to have greater sway.

Similar quirks are noticeable in other indices. For example the Dow Jones Sustainability World Index includes the casino management company Las Vegas Sands, whilst the S&P 500 Value Index includes animal medicine producer Zoetis trading on 30x forward earnings. These odd index holdings raise questions about how well end-clients understand their underlying holdings and highlights how hard it is to predict a company being included in an index, along with the associated buying or selling pressure.

Determining the correct price of an asset based on a business’s fundamentals is left to active managers managing a declining share of the market. An inherent assumption of passive investing, when weightings are based on companies’ market values, is that prices are rational and reflect an unemotional assessment of the present value of a business’s future potential. History suggests this is far from true. It is akin to blindly following what the sat-nav tells you, without considering there may be traffic on the road ahead; those in the know take a different route.

Algorithms

The picture is further complicated by the rise of high-frequency (HFT) and algorithmic trading3 impacting daily traded volumes. HFT participants do not generally have a directional view of the market, and instead aim to provide liquidity whilst making small profits each time they trade. Data from JP Morgan for 2022 suggests active fundamental investors accounted for just 30% of daily share trading volumes, while HFT represented 40% and passive funds were the remaining 30%. We find ourselves in a situation where, more often than not, a decision to trade is no longer based on an assessment of the underlying company’s fundamentals.

David Einhorn described the situation with HFTs recently: ‘the algorithms are just trying to figure out what everyone else is doing…They’re trying to trade it 1 nanosecond before you and be right 56% of the time’. These market participants are not thinking like a human, because they aren’t human. Markets resemble a hall of mirrors today where it is harder to distinguish what is real and what is fake.

The behaviour of these HFT liquidity providers during periods of prolonged market stress is also uncertain. Unlike market makers, they are not required to continuously offer quotes to ensure markets function. If HFT participation suddenly reduces, many shares would be less liquid than they appear.

The Market has Changed

An outcome of these new market dynamics is that short-term share price moves are harder to predict. A company may report a successful new product launch, but if less of the market is carrying out fundamental analysis it could go largely unnoticed. Research from 2022 suggested that passive investing has led to around -15% less elastic demand for stocks over the last 20 years. To take account of this, investors should focus instead on longer-term strategies, informed by fundamental analysis of the underlying businesses and the valuations they trade on.

Passive index funds have also made the market more fragile. It is likely to be bad news if there are fewer active investors in the market asking themselves ‘is this really a good idea?’, and more in passive funds saying ‘we’ll buy whatever is going up the most and sell whatever is going down the most’. Arguably 2021 was an example of this, when free money collided with price-insensitive passive buying. We should expect greater volatility in both directions, as passive investing risks perpetuating downwards as well as upwards momentum.

These trends should however give patient active investors an edge, as there will be larger market dislocations and distortions. When everyone else is selling, it is often not the best time to sell, but that is exactly what passive funds will be doing. In the multi-asset strategy’s equity portfolio, we are valuation-sensitive and have always avoided buying into market momentum. Passive funds are valuation-insensitive and pro-momentum by design. By avoiding the hype and stepping back as markets reach hysteria, we should avoid the most severe drawdowns.

Our view is that today we may be closer to the market top than its bottom, but we are ready to take advantage of attractive valuations when they present themselves. The preponderance of price-insensitive market participants may provide the opportunity. Whilst passive funds and HFT make market moves harder to interpret, we are comforted by the resilience of the high-quality companies we own. We have been reducing our exposure to parts of the market that feel excessively valued and focusing on companies that have been left behind. As the narrow rally plays out, we remain patient and are ready to buy when we are rewarded by the market for doing so.

1BlackRock, Vanguard, State Street.

2Chang, Y. C., Hong, H., & Liskovich, I. (2015). Regression discontinuity and the price effects of stock market indexing. Review of Financial Studies, 28, 212– 246.

3Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume.

Disclaimer

All information in this document is correct as at 30 June 2023 unless stated otherwise.

Please refer to Troy’s Glossary of Investment terms here. The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party.

Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The investment policy and process of the may not be suitable for all investors. Tax legislation and the levels of relief from taxation can change at any time. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. © Troy Asset Management Limited 2023