Stocks for life, not just for Christmas

Gabrielle’s household has a new member. Ida is a 12-week-old Labrador puppy – very sweet and much loved. Like all puppies, however, she is also messy, needy, and destructive. Hard to tell that from her photo!

It is in the nature of portfolios that not all investments are perfectly behaved at all times. Disappointment is inevitable; accidents and mistakes happen. The important thing is to have an investment process and culture to deal with problems when they occur, and to learn the relevant lessons.

The question then naturally arises: When do you sell? This is especially relevant for the Fund because it is both concentrated and has low turnover – setbacks will therefore have a material impact on the Fund’s progress, and we are naturally reluctant sellers. We see our patience as a competitive advantage, and we are more likely to see lower prices as opportunities to add to our investments than occasions for their sale. It is usually in the presence of controversies that the long-term potential of our stocks is most underestimated. Recent additions to existing holdings in Agilent Technologies, Diageo, Heineken, and Roche fit this pattern. We believe them to represent good opportunities for the Fund in part because their share prices are depressed by recent news. We remain confident in their longer-term prospects.

When to sell

Nevertheless, very occasionally an outright sale is the right course of action. We are not afraid to move on from investments, and we sell for one of three reasons: When valuations become too rich; we have better uses for the capital; or when we get it wrong. The former two categories are far more common than the last one because we set such a high bar to enter the portfolio in the first place. All the Fund’s companies are good businesses by any measure. There is also often overlap between motives for a sale because valuations drive opportunity cost, and better ideas arise when confidence in one company is undermined compared to another. They can also be in conflict. Stock prices usually move fast to reflect bad news and selling at a low price can compound an error. We think and act like business owners and seek to be careful about the valuations and timing at which we buy and sell.

To illustrate some of these complexities, here are three examples of recent sales from the Fund.

The Fund’s allocation to the consumer staples sector has reduced significantly in the past three to four years, from ~22% at the end of 2019 to ~13% currently. The sector is a natural home for the Fund, and we are happy to remain invested in the companies we have retained. They have competitively advantaged brands and global distribution networks that generate steady growth and attractive returns on capital. However, over the last few years we have sold several investments in the sector, primarily for valuation reasons. At ultra-low interest rates many staples companies reached historically high valuations at a time when we became increasingly concerned about their balance sheets, cash flows, and more complicated environmental footprints. As valuations and growth rates normalise this year, the Fund’s sales have added significant value through the reallocation of capital towards higher performing assets.

Accounting-software provider Sage was sold from the Fund in the summer of 2019. Its valuation at the time was similar to Microsoft’s, which made little sense to us because Microsoft consistently grows faster, driven by the strength and diversity of its various franchises. The Fund’s ownership of Sage’s direct rival Intuit was also instructive – Intuit had long demonstrated far better management. Since the sale of Sage, Microsoft has returned +143% (+23% CAGR), Intuit +89% (+16% CAGR) and Sage +23% (+5% CAGR).1

What of the mistakes? We achieved a favourable exit from eBay in 2021 and early 2022, having retained the shares when they were depressed. We consider the investment a mistake because we misread the quality of eBay’s management and their ability to address competitive challenges.

We have retained holdings in Medtronic and PayPal despite recent disappointing operational and share-price performances2. In both cases we believe them to have rare and valuable assets, the scarcity of which are not fairly recognised in today’s lowly share prices. Moreover, we see a path towards operational improvement in the nearer term, and we believe it would be an error to sell them today when sentiment is so poor. Their acknowledged challenges are instead reflected in their lower weights in the Fund. Just as we allow our winners to run, we allow losers to whittle when conviction diminishes.

Adapt or die

These are not easy choices, and ideally, we would not have to make them. Instead, we would simply buy and hold great companies for as long as they fit our criteria for quality and for value. For this to happen over long periods, it is essential that our companies reinvest, adapt, and grow. When we first became investors in Alphabet in 2013 (when it was still called Google), YouTube and the Google Cloud Platform were not such meaningful drivers, to say nothing of AI. Likewise, when we first became an investor in Visa in 2016, value-added services and new payment flows (beyond traditional consumer-to-merchant transactions) were not significant engines for growth. Since these initial investments, Alphabet’s and Visa’s growth in free cash flows per share has exceeded their total shareholder return as operational performance, not valuation, accounts for very healthy, double-digit annualised returns. Their returns highlight the persistent inefficiency in pricing these rare businesses that the Fund’s strategy is designed to exploit.

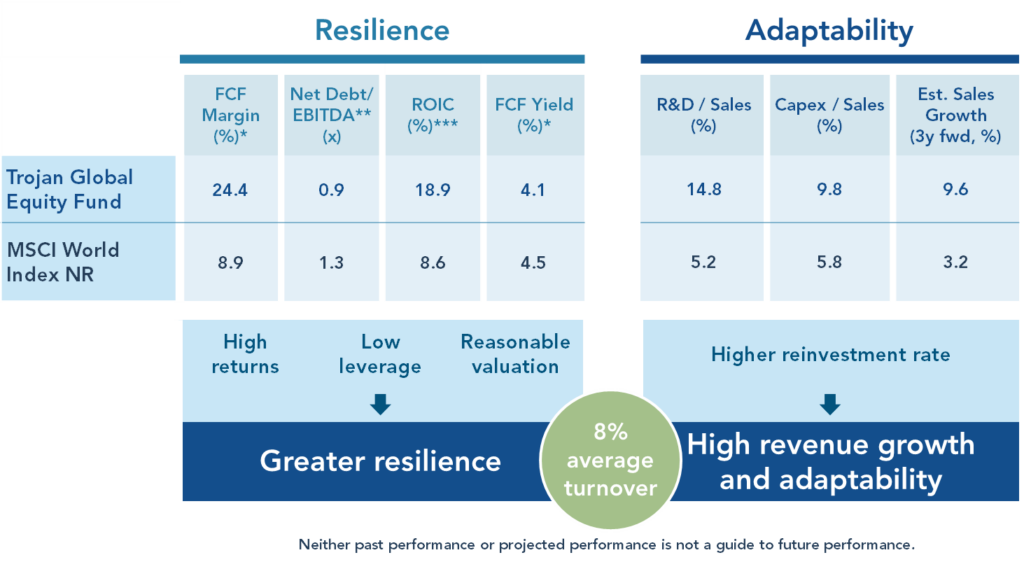

These positive developments require management to invest over many years to support a vision of where they want to take their companies. It is why we prefer to see companies consistently reinvesting large sums back into brand-building, research and development and capital expenditure, rather than sweating their assets for immediate margin and cash flow. Our companies are faster growing and more adaptive because of this, and they generate great cash margins and returns on capital despite this higher rate of reinvestment (see Appendix I).

Experian’s involvement in Brazil provides a further example. Experian became a majority owner of local credit bureau Serasa in 2007, buying out most of the minorities in 2012. The investment was made with the expectation that one day the Brazilian regulator would allow Brazilian financial institutions to lend (as Anglo-Saxon counterparts do) not just according to ‘negative data’ (i.e. data affirming late repayments and loan defaults), but also according to ‘positive data’ (i.e. data affirming the timely repayment of loans). The introduction of positive data to other markets has significantly increased the availability of credit to the economy, boosted economic growth, and enhanced demand for credit data. This change was a very long time coming in Brazil, involving several painful economic cycles. Experian patiently invested into its local brand, product, and infrastructure, such that when positive data finally arrived in 2019, it was well-positioned to capitalise on the change. Experian’s growth in Brazil has since doubled from an average of +10% p.a. to +20% p.a. as the company quickly brings all the product developed in the US and UK to its Brazilian subsidiary. Serasa has an estimated 65% share of a market that remains immature. Its vast opportunity is a direct result of far-sighted reinvestment, and its value helps underpin our confidence in Experian’s growth and share price.

Adaptation applies to us as investors as well as the companies in which we invest. We think our willingness to evolve as investors is one of the ways that we differentiate from our peers. The context in which investors operate is constantly reshaped by technological, societal, and competitive trends. We therefore believe it is essential to remain open-minded as to what constitutes the highest quality companies in the world and where investment opportunities might reside. To continually improve the Fund, we depend on the strength and depth of Troy’s investment team. A new paper from Tom Yeowart, Troy’s Deputy Head of Research, explores the team’s organisation and culture (see here).

Thank you for your continued interest in the Trojan Global Equity Fund.

Appendix I

*A profitability ratio that measures a business’ cash from operating activities, less capital expenditure, as a percentage of its revenue over a given period. Free Cash Flow Yield is a financial valuation ratio that divides the free cash flow a company earns against its market value. **A ratio measuring the amount of income generated and available to pay down debt before covering interest, taxes, depreciation, and amortisation expenses. ***A measure of financial performance that calculates how efficiently a company’s management is utilising all forms of capital available. Source: FactSet and Troy Asset Management Limited, 30 September 2023. Free Cash Flow measures are based on trailing figures over the last 12 months. Asset allocation subject to change. Estimates may not be achieved.

123/07/19 to 19/10/23. Total Returns in GBP.

2Both have been owned in the Strategy since its inception almost a decade ago – in PayPal’s case when it was still part of eBay.

Disclaimer

Please refer to Troy’s Glossary of Investment terms here. Fund performance data provided is calculated net of fees with income reinvested unless stated otherwise. All performance and income data is in relation to the stated share class, performance of other share classes may differ. Past performance is not a guide to future performance. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The historic yield reflects distributions declared over the past twelve months as a percentage of the fund’s price, as at the date shown. It does not include any preliminary charge and investors may be subject to tax on their distributions. Any reference to benchmarks are for comparative purposes only. Tax legislation and the levels of relief from taxation can change at any time. Any change in the tax status of a Fund or in tax legislation could affect the value of the investments held by the Fund or its ability to provide returns to its investors. The tax treatment of an investment, and any dividends received, will depend on the individual circumstances of the investor and may be subject to change in the future. The yield is not guaranteed and will fluctuate. Any objective will be treated as a target only and should not be considered as an assurance or guarantee of performance of the Fund or any part of it. The fund may use currency forward derivatives for the purpose of efficient portfolio management.

Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. Any decision to invest should be based on information contained in the prospectus, the relevant key investor information document and the latest report and accounts. The investment policy and process of the fund(s) may not be suitable for all investors. If you are in any doubt about whether the fund(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party.

The Fund is registered for distribution to the public in the UK but not in any other jurisdiction. The sub-funds are registered for distribution to professional investors only in Ireland.

The distribution of certain share classes of the sub-funds of Trojan Investment Funds (“Shares”) in Switzerland is made exclusively to, and directed at, qualified investors (“Qualified Investors”), as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended, and its implementing ordinance. Qualified Investors can obtain the prospectus, the key investor information documents or, as the case may be, the key information documents for Switzerland, the instrument of incorporation, the latest annual and semi-annual report, and further information free of charge from the representative in Switzerland: Carnegie Fund Services S.A., 11, rue du Général-Dufour, CH-1204 Geneva, Switzerland, web: www.carnegie-fund-services.ch. The Swiss paying agent is: Banque Cantonale de Genève, 17, quai de l’Ile, CH-1204 Geneva, Switzerland.

Certain sub-funds are registered in Singapore and the offer or invitation to subscribe for or purchase Shares in Singapore is an exempt offer made only: (i) to “”institutional investors”” (as defined in the Securities and Futures Act, pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore, as amended or modified (the “”SFA””); (ii) to “”relevant persons”” (as defined in Section 305(5) of the SFA) pursuant to Section 305(1) of the SFA, and where applicable, the conditions specified in Regulation 3 of the Securities and Futures (Classes of Investors) Regulations 2018; (iii) to persons who meet the requirements of an offer made pursuant to Section 305(2) of the SFA; or (iv) pursuant to, and in accordance with the conditions of, any other applicable exemption provisions of the SFA. “

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. Any fund described in this document is neither available nor offered in the USA or to U.S. Persons.

© Troy Asset Management Limited 2023.