The UN Principles of Responsible Investment Annual Conference – The coming of age of responsible investment

In the final quarter of 2022, Troy attended the PRI (United Nations Principles of Responsible Investment) annual conference. Four themes leapt out at us and form the basis of this report.

Climate, Climate, Climate

Eight years ago, I gave my odds at 50:50 that we would retain enough stability [to prosper through the transition to net zero]. Recently I revised that down to 40:60. We are not wining this race.

Jeremy Grantham, veteran investor, and founder of the Grantham Institute at the 2022 PRI conference.

Climate change remains the central ESG issue for many investors, but over the course of 2022 the economic sensitivities of the transition have been highlighted by the war in Ukraine and the subsequent spike in energy costs. Simultaneously, erratic global weather has reinforced the necessity of that same transition. The result is that the climate debate, which attracts dogma on both sides, has had to become more nuanced.

This refinement is illustrated by an increasing preference for an engagement, rather than divestment, led approach when seeking to address carbon intensive companies within portfolios. While divestment may have a marginal impact on the cost of capital for carbon intensive assets, it is a blunt tool that has limited direct influence on corporate behaviour. The risk of a divestment led approach is that carbon intensive assets move beyond the purview of public markets and responsibly-minded investors, doing little to reduce the systemic risks posed by climate change. Conversely, engaging with companies can positively influence management’s decisions and encourage ‘real world’ change. That is not to say that divestment shouldn’t be a part of an investors’ toolkit; it can mitigate portfolio risk when engagement has failed.

This shift in best practice supports the engagement led approach that underpins Troy’s commitment to net zero and our established approach to climate change mitigation.

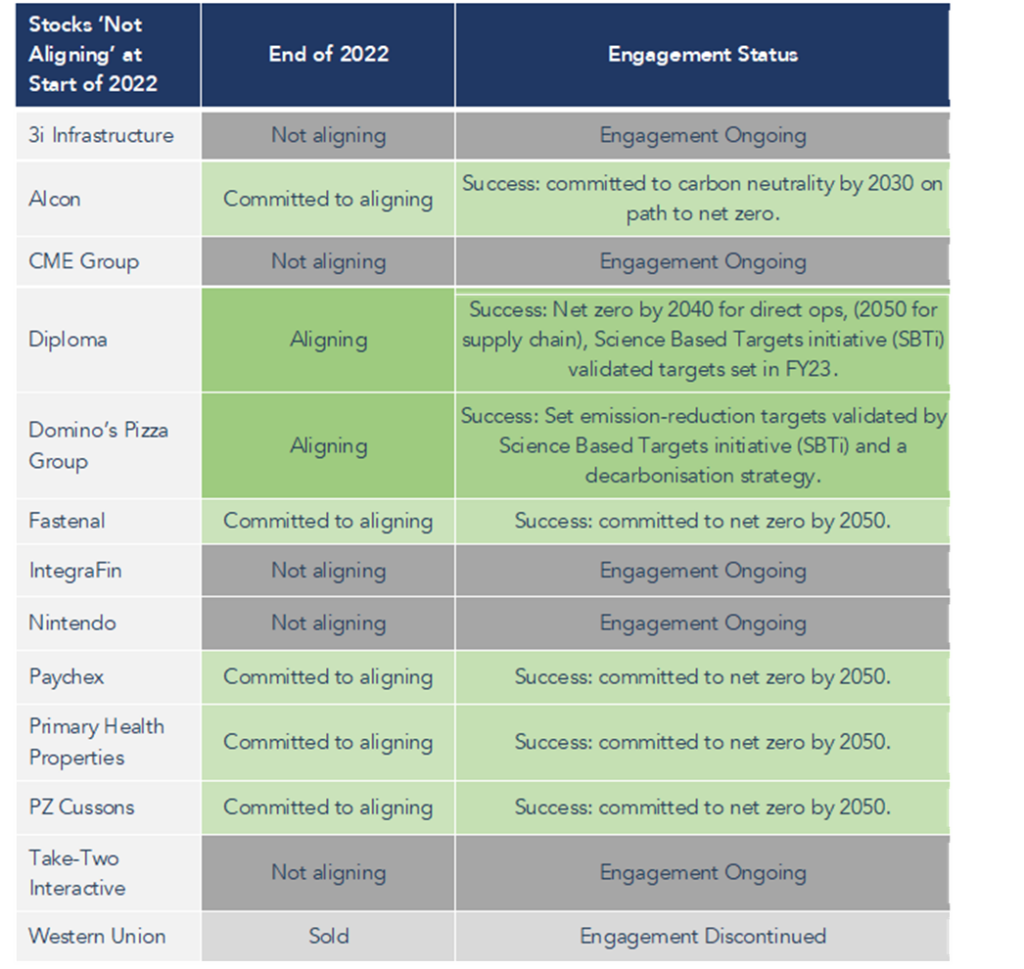

Troy started the year with 14 portfolio companies that had yet to make a commitment to achieve net zero emissions by 2050 or sooner. We have engaged with all these companies and in the last year have seen seven of them either committing to align with the goals of the Paris Agreement or announcing climate targets (See Figure 1). This now leaves only six companies (as one was sold) across Troy’s portfolios that we classify as ‘not aligning’ to a net zero pathway. All these companies remain the subject of ongoing engagement. We also continue to engage with other holdings to encourage them along the path to net zero.

Figure 1:

Source: Troy Asset Management Limited, 31 December 2022.

Climate discussions at the conference also focused on the danger of allowing the transition to drive further inequality in society. It was this topic, in the context of the ‘global north’ versus ‘global south’, which dominated much of COP 271 in Sharm El Sheikh. However, the same tensions also exist within developed market economies. In the US, where lower skilled jobs in high carbon emitting ‘brown’ industries risk being replaced by higher skilled ‘green’ jobs, the issue has driven political tensions. Companies who wish to retain their licence to operate will need to consider how they can mitigate the adverse social effect of their transition plans. Our analysis suggests most companies have further work to do in this area, representing an opportunity for continued engagement.

Nature’s Role

It has been clear for a long time that the risks associated with climate and nature are inextricably linked. Nature, from sea grass and soil to pine forests and peat, gives us some of the best tools to combat climate change. As such, investors must give due consideration to the nature associated risks and opportunities of their investments.

The lack of consciousness of how our excess capital is recycled into the economy is perhaps the biggest omission of the system

Emmanuel Faber, Chair of the ISSB, 2022 PRI Conference

The recommendations of the TCFD provide a framework for addressing the systemic risks posed by industrial emissions2. The conference reflected a clear appetite for a similar framework for assessing nature-related risks and opportunities. The ongoing development of the Taskforce on Nature-related Financial Disclosure (TNFD) and the launch of Nature Action 100 at COP 15 in Montreal will go a long way to informing best practice in this area3.

While Troy’s portfolios have relatively little exposure to carbon intensive sectors, several of our largest holdings, including Nestlé, P&G and Unilever, have important agricultural supply chains. This creates a material exposure to a number of environmental factors captured under the umbrella of nature. In recent years we have sought to understand these risks better through thematic research on water scarcity, biodiversity and deforestation. We have also engaged with companies on these issues both collaboratively (through the Carbon Disclosure Project) and bilaterally. Nature-related issues accounted for almost a quarter of Troy’s total 2022 engagements with the focus mostly being on enhancing disclosure at this stage.

Lobbying – An alarm bell

A major challenge for responsible investors is to go beyond the glossy corporate sustainability reports and layers of policy, to uncover how businesses are actually behaving.

Over recent years the analysis of lobbying spend has emerged as an important tool in this endeavour. The way companies seek to influence regulation and policy has not always been well aligned (and in certain instances has been in direct contradiction) with the messages in their sustainability reporting. Whether it be in relation to matters such as vehicle emissions regulations or mineral exploration rights, corporate lobbying wields significant influence and provides insight to investors on whether companies are ‘walking the walk’.

Although there were relatively few lobbying related shareholder resolutions tabled at the 2022 AGMs of Troy holdings, Troy has supported resolutions demanding lobbying disclosure at Meta and Alphabet. The absence of oil & gas companies across Troy’s portfolios meant we did not see lobbying resolutions in relation to climate issues for Troy holdings in 2022. However, as active participants in the Climate Action 100+ engagement with Unilever, we have seen the issue of lobbying rise up the proposed agenda.

We expect to see the increased scrutiny of lobbying in 2023 and look forward to the insights this may provide.

Trust in ESG

Whilst the conference’s title “The coming of age of responsible investing” reflects the advances responsible investment has made over the last decade, it also alludes to the trials associated with its passage to maturity. The process of introspection that has followed energy market disruption, higher inflation and geopolitical instability has highlighted a number of risks. At one end of the spectrum, investors seeking impact have periodically driven up the valuation of so called ‘ESG-positive’ and ‘green’ investments (although recent market moves have seen some correction here). At the other end, the proliferation of responsible investment terminology and strategies has elevated the risk of a mismatch between investor expectations and the ESG performance of their investments.

This is not surprising. In the same way that biological proliferation and evolution has always spiked after great geological extinction events, ESG evolved rapidly out of the aftermath of the Global Financial Crisis (GFC), taking many shapes, from ethical investing to impact investing. The role of rationalising this expansion has fallen to regulators. While a regulatory framework is necessary to ensure the continued healthy growth of responsible investing, it also comes with risks to future innovation and diversity of offering.

The wave of new ESG regulation breaking over the industry includes separate frameworks from the EU, UK and US regulators. Troy has already classified several of its Funds as Article 8 under the EU’s SFDR4 framework and is currently navigating the UK’s Sustainable Disclosure Requirements regulation. Details of the US Securities Exchange Commission’s ESG regulation have yet to be made public.

As we navigate these new pieces of regulation and the wider ‘coming of age’ of ESG, we are excited by what responsible investment has to offer investors. We continue to ensure we stay true to Troy’s investment philosophy and adhere to our core responsible investment principles of materiality, long-termism and engagement. As ESG further matures and global reporting standards consolidate we see increased long-term value and opportunity arising from collecting insights on ESG factors. These augment our research and build a richer mosaic of information from which to judge the quality and sustainability of our investments.

1The 2022 United Nations Climate Change Conference or Conference of the Parties of the UNFCCC, was held from 6-20 November 2022 in Sharm El Sheikh, Egypt.

2Taskforce on Climate-related Financial Disclosure

3V0.3 of the Taskforce on Nature-related Financial Disclosure framework is currently out for consultation. Further details of Nature Action 100 can be found at https://www.natureaction100.org/. COP 15 is the 2022 UN Biodiversity Conference of the Parties to the UN Convention on Biological Diversity, held in Montreal from 7-19 December 2022.

4The Sustainable Finance Disclosure Regulation (SFDR) is a European regulation introduced in 2021 to improve transparency in the market for sustainable investment products.

Important Information

Further information relating to how ESG integration is applied to the fund can be found in the fund prospectus and investor disclosure document. For further information relating to Troy’s approach to company voting and engagement, please see Troy’s Responsible Investment and Stewardship Policy available at www.taml.co.uk.

The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party.

Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The investment policy and process of the may not be suitable for all investors. If you are in any doubt about suitability for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. All reference to FTSE indices or data used in this presentation is © FTSE International Limited (“FTSE”) 2023. ‘FTSE ®’ is a trademark of the London Stock Exchange Group companies and is used by FTSE under licence.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: Hill House, 1 Little New Street, London EC4A 3TR. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. No fund described in this document is neither available nor offered in the USA or to U.S. Persons.

Copyright © Troy Asset Management Ltd 2023