Steady growth

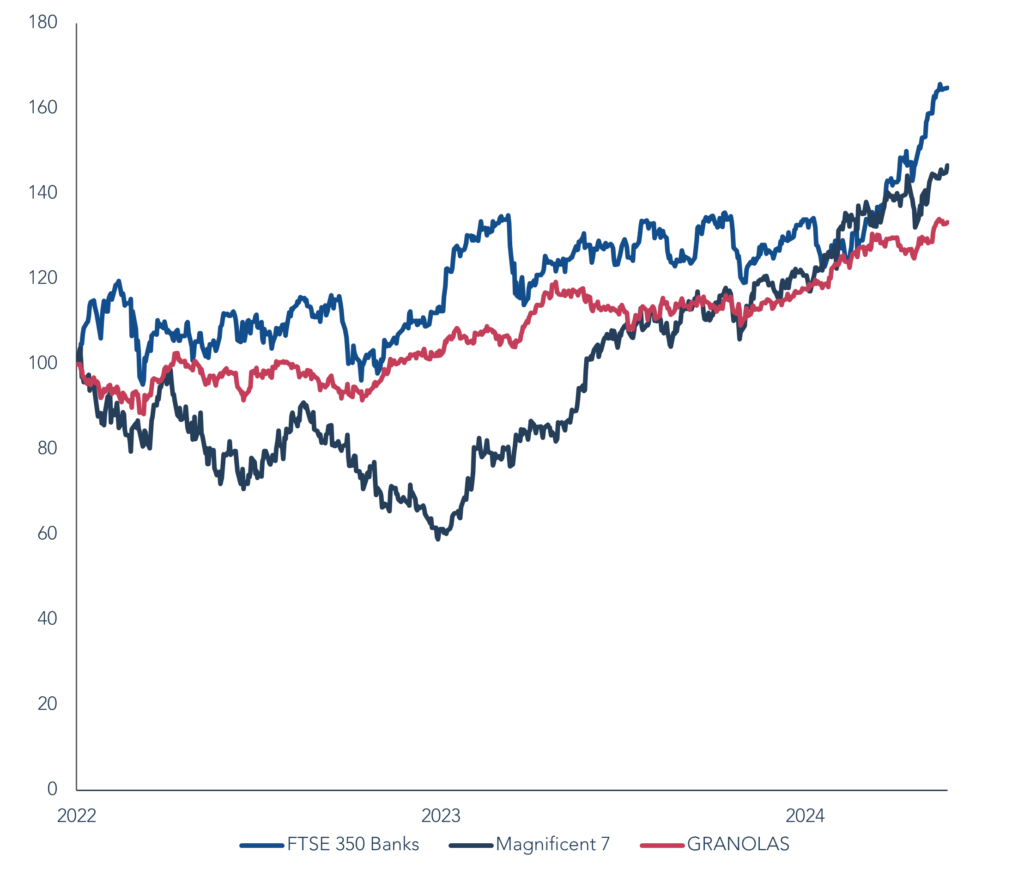

In the first five months of the year, the Troy Global Equity Strategy (the ‘Strategy’) has made steady progress, up +4.8%. After a strong result in 2023, the Strategy finds itself behind the comparator benchmark, which is +9.7%.¹ As fellow shareholders of the Strategy, we are naturally optimistic about its prospects. However, we are surprised by the strength of markets so far this year and the magnitude of the gains, especially since the multiple interest rate cuts so widely expected at the start of the year have failed to materialise. Economic news has been broadly good, underpinning corporate profits and supporting a broader number of stocks and sectors. The markets are no longer only driven by the ‘Magnificent 7’, or any other small group of large companies. Did you know, for instance, that the share price of bellwether U.S. bank JPMorgan Chase is +17.2% this year? Or that a basket of FTSE 350 banks has outperformed the Magnificent 7 and a group of Europe’s leading companies since the start of 2022 (see Figure 1)?

This improved breadth is reflected in the Strategy’s own performance. Alongside the usual suspects of Alphabet, Meta Platforms (‘Meta’), and Microsoft, the top five contributors also include payments companies American Express and Fiserv, both beneficiaries of firm economic trends.

Figure 1: UK banks have outperformed the Magnificent 7 and the GRANOLAS* since the start of 2022

Source: Bloomberg, Factset, 21 May 2024. Past performance is not a guide to future performance.

*GRANOLAS: GSK, ASML, Nestlé, Novartis, Novo Nordisk, L’Oréal, LVMH, AstraZeneca, SAP, Sanofi.

At the bottom end of the list of contributors are traditionally more defensive companies drawn from the healthcare and consumer goods sectors. Indeed, if we were to characterise the Strategy’s underperformance so far this year, we would highlight that the Strategy has a strategic preference for businesses that grow in a steady and predictable way. We prefer them because the Strategy can be invested in companies for a decade or more. We therefore want businesses that are resilient through a range of macro-economic and market environments. Whilst currently benign conditions lift a broader selection of stocks, we know that these circumstances cannot last forever. Less favourable trends can emerge at short notice, and we have greater confidence in the durability of our companies (and their share-price gains) than we do the stock market as a whole.

Not so fast, Alexa

The semi-conductor industry is another cyclical sector that has delivered strong returns this year. Explaining the sector’s performance goes beyond the strength of the economy to focus more on the enormous investment currently underway into AI.

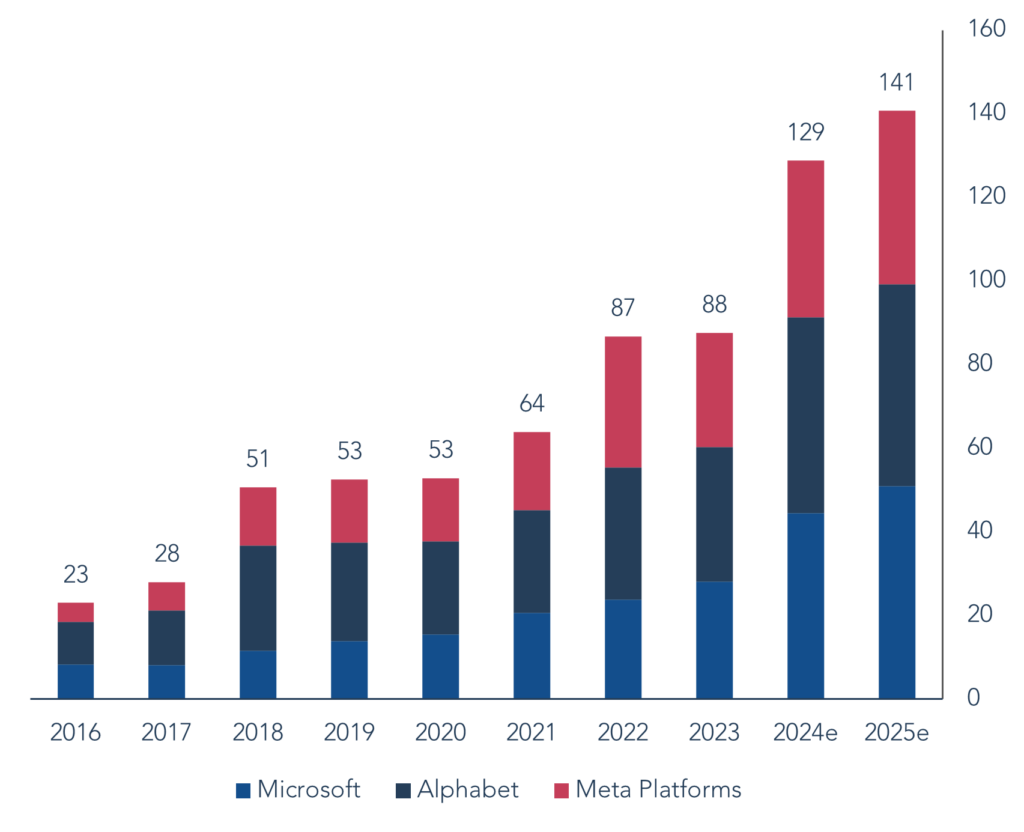

The Strategy’s numerous internet and software companies are, in large part, funding the boom in capital expenditure (‘capex’) from which the semis companies are profiting. Alphabet, Meta and Microsoft will collectively spend ~$130bn in their 2024 financial year, much of it on technical infrastructure (see Figure 2). This represents a +47% increase over 2023. One of the most pressing questions for the Strategy is, therefore, will this colossal amount of money be well spent?

Figure 2: Capex for Alphabet, Meta, Microsoft, $bn

Source: Bloomberg, 21 May 2024.

It has been 18 months since ChatGPT alerted the world about the possibilities of Large Language Models (‘LLMs’). We share the prevailing optimism that generative AI (‘Gen AI’) has exciting and broad applications that have transformative consequences for the way that many jobs get done. It doesn’t take much imagination to see how LLMs will automate many activities – from customer service, graphic design, medical diagnostics, and legal work – freeing up time and resources to deploy elsewhere. The technology is already leading to large productivity gains for software engineers who automate their coding using Microsoft’s GitHub Copilot. Yet beyond software development, the application of LLMs is still in its infancy. Whilst interest among corporates is high, usage and monetisation remain small and experimental. There is also reasonable doubt that consumers and workers will readily adopt ‘AI assistants’ for more complex tasks. In many cases the experience is still too clunky and error-prone, carrying with it significant data quality, governance, and security concerns. The technology needs to mature, and the value proposition must be proven. Customers must also relearn how to do the same things as before with new tools. All this takes time. Even Microsoft’s CEO Satya Nadella – not known to play down the technology’s potential – acknowledges the profound changes that must take place within organisations before the technology is widely adopted.

One of the interesting rate limiters [on adoption] here is culture change inside of organisations. When I say culture change, that means process change… at the end of the day, companies will have to take a process, simplify the process, automate the process, and apply these solutions.

And so that requires not just technology, but in fact, companies to go do the hard work of culturally changing how they adopt technology to drive that operating leverage.

Satya Nadella, April 2024

The element of timing matters because it creates scope for a mismatch between supply and demand, putting at risk some of the hundreds of billions of dollars invested into the technology. The passage of time also increases the likelihood that further advances in AI move the focus away from the first wave of LLMs. These uncertainties are likely to result in stock-market volatility and investment opportunities in the near term, even if the technology fully delivers on its promise to generate significant value for many years to come.

Picking the Gen AI winners

Another pressing question then arises, to whom will the value accrue? It is too early to know for sure, and some humility is required given the speed of technical breakthroughs and the abundance of capital addressing the opportunity. The stock market can be quick to reach its verdict and can reduce the competitive drama to a deathmatch between large incumbents and innovative start-ups. The reality tends to be messier and less conclusive. There can be many ‘winners’ and the history of computing suggests that new generations of technology layer on top of older ones rather than displacing them. What we can say with some confidence is that Gen AI is likely to remain expensive to run, dependent on the quantity, quality and legal legitimacy of its data inputs, and most valuable when it is used by millions if not billions of people. These features play to the strengths of incumbents that already have the resources to compete.² The promise of Gen AI also increases the urgency for corporates to accelerate their move to the cloud, strengthening the tailwind behind the leading trio of cloud infrastructure providers, two of which, Alphabet and Microsoft, are owned in the Strategy.³

Satya Nadella’s observation highlights that the emergence of generative AI is a test of corporate adaptability that applies to all organisations. We are watching all our companies closely to understand how they are responding. We have been pleasantly surprised that an old and highly regulated organisation such as Moody’s (founded in 1909) has shown the ambition and foresight to rapidly integrate generative AI into its services. By contrast, we have seen other companies in the same industry lack the critical elements (IT estate, modern products, ability to partner, management focus) to move with the same speed.

We are optimistic about forward-thinking and data-rich businesses, such as Moody’s, with entrenched customer relationships in specific industries. Adobe (in graphic design), Intuit (in tax preparation and small business accounting), and RELX (in legal and academic publishing) are further examples of this kind of company that are owned by the Strategy. Gen AI has the potential to enrich these companies’ existing products, making them stickier and more valuable for their users, whilst creating a natural way to cross-sell additional services.

Increasing relevance

At an even more basic level, Gen AI reinforces our conviction to invest where value is created. This means investing in businesses at the forefront of change, including those making heavy use of data and software, as well as those businesses that have the cultural willpower and financial capacity to invest aggressively for their future. Our intent is expressed in the Strategy’s transactions so far this year. For instance, we added to the existing holding in LSEG, formerly known as the London Stock Exchange Group. LSEG changed its name because its business is no longer simply an equity trading venue based in London; it is instead a diversified data and analytics provider operating globally across multiple asset classes (equity trading makes up only 3% of group revenues). The company’s partnership with Microsoft, announced at the end of 2022 (in which Microsoft took an equity stake and a seat on LSEG’s Board), was a sign of the transformation underway at the company.4 The Strategy has also recently become an owner of Amadeus . Amadeus is (by far) the world’s leading provider of software and ticketing systems for the travel industry, primarily airlines. We believe the sophistication and enduring value of Amadeus’s services are misunderstood and that the company has a big opportunity to expand its presence in the hospitality sector.

These transactions were partly funded by the disposal of the Strategy’s last remaining shares of Becton Dickinson (‘BD’), a company that was owned by the Strategy since its inception at the end of 2013. As one of the world’s largest providers of consumable and disposable medical devices, it is difficult for BD to significantly outgrow the mature and largely analogue healthcare industry that it serves. In balancing some of the risks and opportunities highlighted above, we also took advantage of higher prices this year to reduce the Strategy’s investments in Alphabet, Meta, and Microsoft. They remain large, long-term parts of the portfolio.

We expect the aggregate of these changes to embed higher rates of growth, consistency and profitability for the Strategy whilst reinforcing its attractive valuation. There remains a compelling opportunity to own the Fund’s collection of outstanding companies at a similar cash-flow yield as the global index. Whatever stock-market gyrations the rest of the year might bring, this anomaly gives us confidence about the future of the Strategy over the longer term.

Thank you for your interest in the Strategy. We wish you an enjoyable summer.

¹ MSCI World NR (£), Factset, 31 May 2024

² The resources are various and formidable in combination, including scarce human talent, large and unique datasets, efficient global infrastructure, trusted brands and service functions, vast customer bases, and financial firepower.

³ The number of mentions Microsoft gets in this Newsletter is indicative of how fantastically the company has positioned itself. We do, however, have reservations about the nature of its partnership with OpenAI, creator of ChatGPT, and OpenAI’s leadership.

4 The shares were already owned in Troy’s UK Income strategy, and we are indebted to our colleague Aniruddha Kulkarni for his collaboration and thorough analysis.

The information shown relates to a mandate which is representative of, and has been managed in accordance with, Troy Asset Management Limited’s Global Equity Strategy. This information is not intended as an invitation or an inducement to invest in the shares of the relevant fund.

Performance data provided is either calculated as net or gross of fees as specified in the relevant slide. Fees will have the effect of reducing performance. Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. There is no guarantee that the strategy will achieve its objective. The investment policy and process may not be suitable for all investors. If you are in any doubt about whether investment policy and process is suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. This is a marketing communication document.

Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. Any product described in this document is neither available nor offered in the USA or to U.S. Persons.

© Troy Asset Management Limited 2024.