Caught in the crossfire – the politicisation of ESG

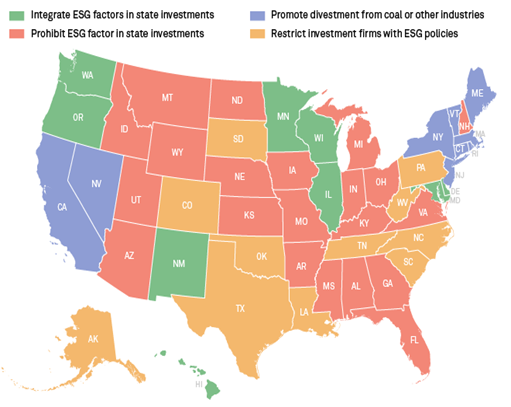

As momentum builds towards next year’s Presidential election in the US, ESG has become a new political ‘wedge issue’1. There is a growing contingent of people who perceive ESG investing to be driven by a moral agenda which works to the detriment of company profitability and investor returns. This negative sentiment towards ESG is best demonstrated by the anti-ESG laws that govern state investments, which have largely been proposed by Republican Governors. Figure 1 shows the US state regulation that either prohibit or restrict ESG factors from being integrated into the management of state investments.

Figure 1 – State Regulation of ESG Investments

Source: Ropes & Gray LLP, S&P Global. Data as at 15 February 2023.

What do we actually mean by ESG?

ESG is both extremely important and nothing special.

Alex Edmans, Professor at the London Business School

In his paper “The End of ESG,” Alex Edmans argues that ESG does not need a specialised term since, at its core, it is about considering and analysing intangibles that create long-term value. This practice is simply part of investing.

Companies do not operate in a vacuum free from government intervention and public scrutiny. As environmental and social issues have, in recent years, garnered increased attention from both regulators and consumers alike, investment professionals have found it harder to ignore such considerations when assessing the long-term prospects of companies and the predictability of their future cashflows.

There is nothing novel or contentious about incorporating non-financial factors into investment decision-making, especially for long-term investors like Troy. We have always sought to invest in companies with strong, effective boards and capable management teams. Experience has also taught us that the durability and resilience of the companies in which we invest is affected by their ability to withstand changing regulatory environments, adapt to evolving consumer preferences and navigate systemic shocks like global pandemics and climate change.

At Troy, we aim to analyse the ESG factors that are material to each company during our investment and research process. We do not employ a prescriptive checklist, nor do we use scores which can risk being too reductive. Every company has its unique merits and challenges. The ESG analysis that we undertake is therefore specific to each company and helps us build a richer mosaic of information on which to judge its competitive advantages and long-term performance.

For instance, over the last few years, we have sought to understand how Nestlé manage the biodiversity impact from land-use in its agricultural supply chain. Following thematic research on the topic of biodiversity in May 2021, Troy met with Nestlé’s Head of Sustainable Agriculture to better understand the company’s Forest Positive strategy. The strategy includes a commitment to deforestation-free commodity sourcing by 2025. Nestlé have also committed to source 20% of key ingredients using regenerative systems by 2025, and 100% by 2030. Nestlé are also increasingly using regenerative agricultural practices2 to source key ingredients like milk, cocoa, coffee, vegetables and cereals.

During the quarter, Troy attended a roundtable with Nestlé’s Chairman where we discussed the company’s progress on their nature-related initiatives. The Chairman spoke about how Nestlé are carefully balancing the environmental and social tensions at play since smaller farmers are generally slower to progress towards Nestlé’s deforestation targets. Nestlé have long supported the livelihoods of smaller, local farmers and are therefore supporting them along the journey to become deforestation-free.

The interplay between social and environmental factors will assume increasing importance for all companies as efforts to restore the environment accelerate over the next decade. We expect companies to demonstrate a strong level of candour and understanding of the tensions between people and planet, and we believe that Nestlé does this well. Solutions will be complicated and require a thorough understanding of the issues, together with a considered and patient approach. This requires companies to look beyond their direction operations.

Whilst an approach that focuses on the nuances and fundamentals of individual companies is more onerous, it allows us to analyse the issues that have the potential to materially impact a company’s long-term results. Recognising that ESG is no more or less than a set of intangible long-term value drivers helps to remove this branch of analysis from the political cross-hairs, in our view.

ESG is also about opportunity

ESG factors are often perceived as risks to be managed. However, changing social and environmental trends also offer opportunities for those companies willing to take them.

A company’s long-term value is relevant to all stakeholders. Companies that maximise value for their shareholders over longer periods tend to create more employment, empower employees, provide greater customer satisfaction and hold themselves to higher standards of corporate responsibility. The promotion of more sustainable products and services can also generate revenues and profits by meeting growing consumer demand for these attributes.

Ethical investing versus ESG

ESG tends to cause confusion, becoming a catch-all term for different shades of green.

Within the industry, many have argued ESG should be spilt in two. On the one hand, it describes a practice of taking ESG issues into account when trying to assess the potential risk-adjusted returns of an investment. On the other hand, ESG can refer to avoiding harm (i.e., ethical investing) or having a positive impact.

Troy’s funds span this divide, according to their specific objectives. We believe that it is our fiduciary duty to consider all long-term drivers of an investment’s value. This increasingly encompasses material environmental and social factors for the reasons mentioned previously. This analysis forms part of our fundamental research, is not informed by a set of moral guidelines and is employed across all of Troy’s investment strategies.

Troy’s Ethical funds employ negative screens in addition to the ESG analysis carried out in our research. These negative screens restrict any investment in harmful sectors, as defined by the relevant fund’s ethical exclusion criteria. Broadly, these criteria prevent the funds from investing in companies which generate a significant proportion of their revenues from the following: alcohol, armaments, fossil fuels, gambling, high-interest rate lending, pornography and tobacco.

Climate change and the Net Zero Asset Manager’s initiative

Climate change is already affecting every region on Earth, in multiple ways.

Panmao Zhai, Intergovernmental Panel on Climate Change

Climate change occupies a unique and important area within the world of ESG. It is a major risk and therefore applies to all companies across all geographies. However, it is also a subject that has created significant debate amongst investors. Vanguard, the world’s second largest asset manager, withdrew from the Net Zero Asset Managers (NZAM) initiative earlier this year. This move has led many to call into question the initiative’s credibility and what it stands for. Critics of NZAM argue that the initiative encourages investors to exercise their influence, both by allocating capital and engaging with companies, to push for carbon reduction. Some claim this is at odds with their fiduciary duty if it harms corporate profitability.

We approach this debate as long-term, active investors in higher quality businesses. No outcome is certain and in our pursuit to act as a responsible steward of our investors’ capital we aim to make educated and informed decisions whilst taking as little unrewarded risk as possible. Climate science is complex and entails predicting potential outcomes far into the future. The one area where the science is generally conclusive is that for every additional degree of global warming there will be more environmental catastrophes and irreversible damage done that will impact entire economies and communities. It is therefore in our interest to reduce this risk as much as we can today to avoid heightened costs tomorrow. For this reason, Troy assesses the climate risks and opportunities of all our investments.

As active investors who favour high-quality companies with strong balance sheets and the ability to re-invest their profits at high rates of return, we believe our portfolio companies are best placed to approach this challenge thoughtfully. Not only do they have adequate resource to adapt to a changing environment, they also typically have management teams who appreciate the commercial benefits of transitioning to a low carbon economy.

Though we recognise the challenges that lie ahead in this transition, we continue to believe that ambition is necessary. We also anticipate that policymakers will eventually take meaningful action to avert future disasters. Troy remains a signatory to the Net Zero Asset Managers initiative and is committed to encouraging our investee companies to align themselves with the transition towards net zero through constructive engagements.

The long path to maturity

We find that the inclusion of ESG considerations in the investment canon is no different to the acceptance of novel political ideas or new technologies. Development tends to go through phases of maturity as the details are exposed to challenges and criticism. Some of these directed at ESG in the last 18 months are well-founded, others are misguided, but all contribute to the establishment of robust standards.

Troy was founded on the principles of independence and common sense, and we are guided by our purpose to protect and grow our clients’ irreplaceable capital over the long term. Our investment process aims to incorporate material changes to the profile of investment risks and rewards, including those related to the environment and societal expectations, whilst upholding high standards of corporate governance. This is an ongoing effort and we look forward to keeping our investors updated as it evolves.

1A wedge issue is a political or social issue, often of divisive nature, which splits apart a demographic or population group.

2 Regenerative agriculture is an approach to farming that aims to improve soil health and soil fertility – as well as protecting water resources and biodiversity. Restoring soil health helps capture increased levels of carbon from the atmosphere in soils and plant biomass and promotes healthier soils which increases crop productivity.

Disclaimer

Further information relating to how ESG integration is applied to the fund can be found in the fund prospectus and investor disclosure document. For further information relating to Troy’s approach to company voting and engagement, please see Troy’s Responsible Investment and Stewardship Policy available at www.taml.co.uk. Please refer to Troy’s Glossary of Investment terms here. The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party.Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The investment policy and process of the may not be suitable for all investors. Tax legislation and the levels of relief from taxation can change at any time. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. All reference to FTSE indices or data used in this presentation is © FTSE International Limited (“FTSE”) 2023. ‘FTSE ®’ is a trademark of the London Stock Exchange Group companies and is used by FTSE under licence. Certain information herein (“Information”) is reproduced by permission of MSCI Inc., its affiliates and information providers (“MSCI”) ©2023. No reproduction or dissemination of the Information is permitted without an appropriate license. MSCI makes no express or implied warranties (including merchantability or fitness) as to the information and disclaims all liability to the extent permitted by law. No Information constitutes investment advice, except for any applicable Information from MSCI ESG Research. Subject also to msci.com/disclaimer. Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP . Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. © Troy Asset Management Limited 2023