‘If we fail to deliver, the consequences will be immense’

Lord Nicholas Stern, Economist and Chair of the Grantham Research Institute

While inflation, a looming recession, and concerns over energy security following Russia’s invasion of Ukraine have all rightly captured people’s attention this year, we have also received powerful reminders that climate change is happening.

This year has seen record-breaking weather events – from heatwaves across Europe, floods in Pakistan and droughts in China, to wildfires in North America. Climate change is not an issue we can afford to put on the backburner.

The Physical Cost of Climate Change

Here in the UK, we experienced the hottest summer on record with peak temperatures of 40°C, nearly double the average daily maximum for July. Many parts of the country ground to a standstill. Perhaps most obviously, our rail network is engineered for temperatures no higher than 30°C, and our housing stock, 75% of which was built before 1980, is ill-equipped for extreme heat. Building resilience to climate change will be costly and will require us to rethink many parts of our infrastructure. That will be no mean feat.

Extreme weather events have an immediate and direct economic cost; researchers estimated that heatwaves lowered overall annual GDP growth across Europe by as much as 0.5% on average over the past decade, owing to reduced productivity. The 2006 Stern Report estimated that the cost of climate change could be equivalent to losing at least 5% of global GDP in perpetuity.[1]

This Is Just the Beginning…

The latest science forecasts that the next decade will see an increase in ‘chronic physical risks,’ which refer to longer-term shifts in climate patterns. Chronic events will take multiple forms, from sustained higher temperatures to precipitation pattern changes, sea level rise and the geographical spread of tropical pests and diseases.

For the companies Troy invests in, this could result in a decrease in labour productivity, damage to physical assets, greater scarcity of critical natural resources such as water and costs incurred from adapting infrastructure to cope with climate change. This is by no means an exhaustive list but captures some of the ways in which we may see value at risk from climate change.

While the spike in energy prices this year may have sharpened the short-term need to find additional fossil fuels, it has not obviated the long-term need for an energy transition and the establishment of renewable infrastructure. Physical climate change is a matter of science rather than sentiment and however urgent the security of the supply crisis may be today, it does nothing to lessen the severity of climate change’s impact tomorrow.

The Climate Conundrum

If we are to reduce the physical risks from climate change, we must become a lower-carbon economy. Such a transition brings its own risks depending on its nature and speed. These risks are referred to as ‘transition risks’.

Such risks occur as policymakers pull different levers to decarbonise the economy. Options include tightening regulation, hiking carbon prices or subsidising green technologies. An example of the former is the UK Government’s ban on the sale of new petrol and diesel or ‘ICE’ (internal combustion engine) cars from 2030. This has required carmakers to make significant investments in new electric vehicle (EV) technologies. It will also reduce the asset lives of existing manufacturing plant and the value of vehicle manufacturers’ intellectual property.

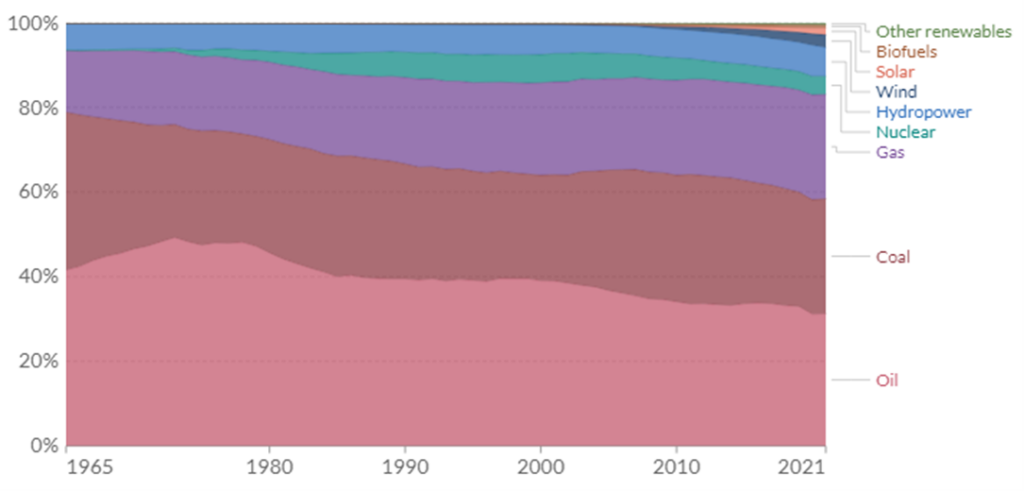

Although the deployment of electric cars is a start, it is just one of a number of policy steps required to prevent a full-scale climate crisis. Many more parts of our economy will need to decarbonise and reduce their reliance on fossil fuels, ideally sooner rather than later. As it stands, the transition has barely begun. Energy usage is still rising rapidly and we have only managed to reduce fossil fuel dependence in our total energy mix by 5% in the last 60 years; from 90% of the world’s primary energy in 1960 to 85% today (see Figure 1).

Figure 1: Global Primary Energy consumption by source (1965 -2021)

The more lacklustre today’s policy response to climate change is, the more severe the cost will be at a future date. A cost that will undoubtedly be felt in investors’ portfolios. The question is not whether to act, but what to prioritise – policymakers will have to balance transition risk against physical risk. Herein lies the climate conundrum.

Climate Scenarios

Investors will have to be agile to navigate policy makers’ shifting response to this conundrum. We have already seen Covid-19, Russia’s invasion of Ukraine and the related cost of living crisis prompt a reconsideration of many countries’ decarbonisation strategies. The latest United Nations Environmental Programme emissions gap report has warned that we are on track for an up to 2.6°C temperature rise by the end of the century.

Kicking the can down the road in this way reduces transition risk today but increases the possibility that, a few years from now, policymakers realise we are heading for climate disaster and aggressively pull all levers in a rapid and disorderly fashion. In such a situation, we could find ourselves with both heightened transition risks and heightened physical risks. This scenario, developed by the United Nations Principles for Responsible Investment (UN PRI), is known as the ‘inevitable policy response’. Such a scenario would severely impact asset prices across financial markets but the alternative would be much, much worse.

These different possibilities give rise to ‘climate scenarios’ which serve as illustrative pathways towards hypothetical futures with different global temperatures. They are based on a number of assumptions with varying degrees of probability as to whether or not they will occur. The Intergovernmental Panel on Climate Change (IPCC) have developed a range of scenarios and the truth is, any one of them could represent reality. At Troy, our priority is to ensure our investment portfolios are resilient enough to withstand a wide range of potential outcomes.

Troy’s Approach to Climate Risk

Two things are certainly clear when it comes to climate change. First, we cannot stand still, and second, we must all play our part.

Troy’s aim is to protect and grow our investors’ capital over the long-term. Our investment process puts risk management at the heart of our analysis, forcing us to be alert to near and distant threats, and responsive as new dangers emerge. Climate-related risks are now taking far greater prominence in our investment process because they are systemic and affect all of Troy’s assets, one way or another.

Balancing the long and short-term interests is difficult. Incentives to act are often misaligned, as the most catastrophic impacts of climate change will likely be felt beyond the shorter time horizons of today’s governments and management teams. Some may even fall outside the time horizons of long-term investors.

Troy’s approach to assessing both the transition and physical risks faced by our investee companies has been an iterative process and will continue to evolve as both the policy landscape changes and different physical risks start to manifest. The non-linear nature of climate-related risks makes for uncertain predictions, but that does not prevent us from using the tools and data at our disposal to uncover the vulnerabilities and opportunities in our portfolios and engage with corporate management to address relevant risks.

A Strong Start Point

All Troy portfolios start from a strong base; they have a much lower carbon footprint than their respective benchmarks, meaning we typically hold less carbon-intensive companies. For our Article 8 funds[1], we prioritise carbon reduction in the real economy. This consideration goes beyond an analysis of the risk and opportunities associated with climate change and considers the real world impact our holdings have on the environment. This means that, irrespective of a company’s starting point, we want to see decarbonisation with a 2050 net zero goal in sight. Furthermore, we also believe that a company’s response to climate change provides a valuable insight into its corporate culture, management’s objectives and their alignment with truly long-term owners.

Much like the way businesses navigated the uncertainties of the Covid-19 pandemic, Troy’s response to the threat of climate change has been a significant and important undertaking which has involved the entire organisation. We have worked collaboratively combining investment management, stewardship and client servicing efforts with regulatory, compliance and operational ones.

We firmly believe in the need to strive towards a net zero 2050 target aligned with the goals of the Paris Agreement. In light of this belief, Q3 saw Troy formally set a net zero target under the Net Zero Asset Managers’ Initiative (NZAMI).

Our Net Zero Commitment

Achieving net zero emissions by mid-century is our best bet at staying on track to meet the goals of the Paris Agreement and avoiding the worst effects of climate change. To this end, Troy became a signatory of NZAMI in 2021 and published our first formal climate-related targets in July 2022[1].

While our long-term commitment is to invest all assets under management in alignment with the objectives of Paris Agreement, we have made an interim commitment to manage all Troy’s open-ended investment funds in line with net zero. As we receive consent from asset owners we expect to expand this alignment to cover Troy’s other portfolios. For relevant portfolios within the Multi-asset strategy, this commitment applies only to equity investments at this stage, owing to a lack of established methodology for Paris-aligned investing in sovereign bonds and gold-related investments.

For these net zero aligned funds, we have set the following targets:

- 100% of companies must classify as net zero, aligned to net zero or aligning to a net zero pathway by 2030 (85% by 2025)

- Emissions to be reduced by 50% by 2030, against a 2019 baseline

- 40% of portfolio emissions to be subject to direct or collective engagement by 2025

Our approach is supported by an active ownership strategy that prioritises engagement over divestment.

Climate Engagements

We have had several successful engagements with investee companies over the last 24 months to align them with a net zero goal. A few examples are illustrated below.

Last year, we encouraged Agilent Technologies to set a net zero target and advised on the requirements of a credible decarbonisation plan. Following this engagement, in October 2021, Agilent committed to net zero and set interim carbon reduction targets of 50% by 2030 (for all direct carbon emissions) and a 30% carbon emissions reduction for their value chain, these reduction targets are set from a 2019 base year.

At the beginning of this year, Troy engaged with other holdings including Visa and Domino’s Pizza on the topic of net zero. Again, we asked the companies to consider short- and medium-term emissions reduction targets to serve as way markers on their path towards achieving net zero.

Positively, both Visa and Domino’s Pizza have set emissions reduction targets for both their direct carbon emissions and those of their value chain. Both companies’ targets have received validation from the Science-Based Targets initiative, and both became members of the ‘Business Ambition for 1.5 °C’ initiative.

Though a net zero by 2050 target is important, it is insufficient to drive decarbonisation today if unaccompanied by five–ten-year targets. This is because it defers the problem and all responsibility to future board members and executive management teams. If there is anything the climate conundrum has taught us, it is that a transition takes time and the sooner it begins, the more orderly it will be.

Across all of Troy’s portfolios, we have ten companies who are yet to set a net zero target. We have an engagement underway with all of them, supported by open and ongoing dialogues. In the quarter we have further advanced our engagements with three of these companies, Alcon, Nintendo and Fiserv.

Where we feel insufficient progress has been made, we have begun to vote against the re-election of directors as a form of escalation. In the recent AGM season, Troy voted against the re-election of the Chair of the Governance and Nominations Committee at Alcon. Following this vote, we wrote to the company to explain our decision and reiterated our desire to see progress on a climate change strategy. We have since had a constructive meeting with the Head of ESG and hope to see a target published at the next reporting opportunity.

With the AGM season largely over there were few significant climate related votes in the quarter. We were please to support National Grid’s ‘Say on Climate’ resolution which we have previously highlighted.

Troy will continue to engage both directly and collaboratively via initiatives such as the Carbon Disclosure Project and Climate Action 100+ to drive meaningful change where we can.

We Cannot Succeed Alone

Portfolio emissions reduction is inextricably linked to the pace at which global economies decarbonise. This depends on factors such as renewable energy availability, regulation and the viability of low-carbon technologies, which are neither within our control nor the control of our investee companies. Troy has recently signed the 2022 Global Investor Statement to Governments on the Climate Crisis ahead of COP-27 to encourage a more effective policy response. Without a policy framework to support the low-carbon transition, achieving net zero within Troy’s portfolios is unlikely to be possible, however hard we push investee companies.

Despite this, we are not deterred from being ambitious in our approach to climate change mitigation[1]. This is because, if unaddressed, the changing climate will have far reaching consequences for all people, all economies and the health and stability of all aspects of the financial system.

The above targets, supported by our engagement activity, represent only some of the steps along our journey towards alignment with the goals of the Paris Agreement. We look forward to updating you on our progress.

[1] See Troy’s Climate Change Mitigation Policy

[1] Using the Paris Aligned Investment Initiative’s Net Zero Investment Framework

[1] Classified as Article 8 under the EU’s SFDR.

[1] Stern Review, The Economics of Climate Change

Disclaimer

Further information relating to how ESG integration is applied to the fund can be found in the fund prospectus and investor disclosure document. For further information relating to Troy’s approach to company voting and engagement, please see Troy’s Responsible Investment and Stewardship Policy available at www.taml.co.uk.

The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party.

Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The investment policy and process of the may not be suitable for all investors. If you are in any doubt about suitability for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: Hill House, 1 Little New Street, London EC4A 3TR. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. The fund described in this document is neither available nor offered in the USA or to U.S. Persons.

Copyright © Troy Asset Management Ltd 2022