The allure of dull

Back in 2017, the Lex column at the FT speculated that companies rarely in the headlines make better returns than those frequently on the airwaves¹. We see some logic in this, given news services generally focus on bad news. The Lex team picked out some of the ‘least newsworthy’ large UK companies and have noticed that they have tended to be consistent outperformers. We share a common love for the quiet compounder. In particular, there is a cohort of business-to-business (B2B) companies who by their very nature are non-consumer facing and rarely in the limelight. These are global, defensive businesses that make steady progress year-on-year without fanfare, often by performing vital, but unexciting and inexpensive, roles in our global economies. Ironically, the very mention of some of them by Lex (and us!) draws more attention to these discrete corners of the market, but we still like them. Names held in your Fund that we would highlight are:

Source: Troy Asset Management. The reference to specific securities is not intended as a recommendation to purchase or sell any investment.

This newsletter zooms in on the first three, which are notable both for their strong long-term total returns to shareholders, and for the source of much of those returns – namely, the acquisition of dozens of other companies over the years.

The right kind of M&A

Mergers and acquisitions are often rightfully viewed with scepticism. Studies by McKinsey (among many others) have found that most M&A deals fail to generate value – by their reckoning, more than two thirds are value neutral or destructive². However, there is a wide spectrum of deals that fall under the ‘M&A’ moniker – from mega-buyouts and mergers like the ill-fated combination of Kraft Foods and Heinz in 2015, through to minuscule ‘bolt-ons’ that are barely noticed. Perhaps unsurprisingly, it is the big deals where most risk lies – high prices, complex integrations, and reliance on cost synergies to make the numbers work all come into play. More interestingly, the same studies have found that ‘programmatic acquirers’ – those consistently making small acquisitions – generated by far the most value³. Bunzl, Diploma, and Halma all sit in this bracket; Bunzl has acquired over 200 companies since 2004, while both Diploma and Halma have bought roughly 100 each since the early 1990s.

One obvious attraction of M&A is as an alternative source of growth. Growing your revenues and earning an attractive return on invested capital (ROIC)4 are the two vital components to generate growing free cash flow. And we think growth in free cash flow is the key long-term driver of value creation and share prices.

Troy’s portfolios all have an aggregate ROIC well above the average of the wider market – one indication of our focus on high-quality businesses. We are also comfortable that all our companies have good long-term opportunities for growth – they are aligned to strong growth trends and have opportunities to reinvest profits into them. Organic growth is almost always the most valuable, typically generating the highest returns on invested capital. Theoretically, we want our companies to retain and reinvest as much cash as possible given the attractive returns they can earn. However, maintaining high organic growth is difficult for many reasons. For example, the planet has finite people and companies to act as customers, meanwhile strong organic growth opportunities attract competition. Finite opportunity means our companies tend to generate far more excess cash than they can feasibly reinvest in themselves.

For example, Unilever could choose to spend all their excess cash on opening new factories or setting up facilities in new geographies. But management know their business and industry and know there are limits to how much capacity they can add – they could build a new factory but the demand may not be there, leading to a poor return on the investment. As a result, our portfolio companies tend to return a significant portion of excess cash to shareholders (via dividends and buybacks) or use it to strengthen the balance sheet (accrue cash/pay down debt). There is much wisdom in these actions, and we welcome management teams observing such capital discipline.

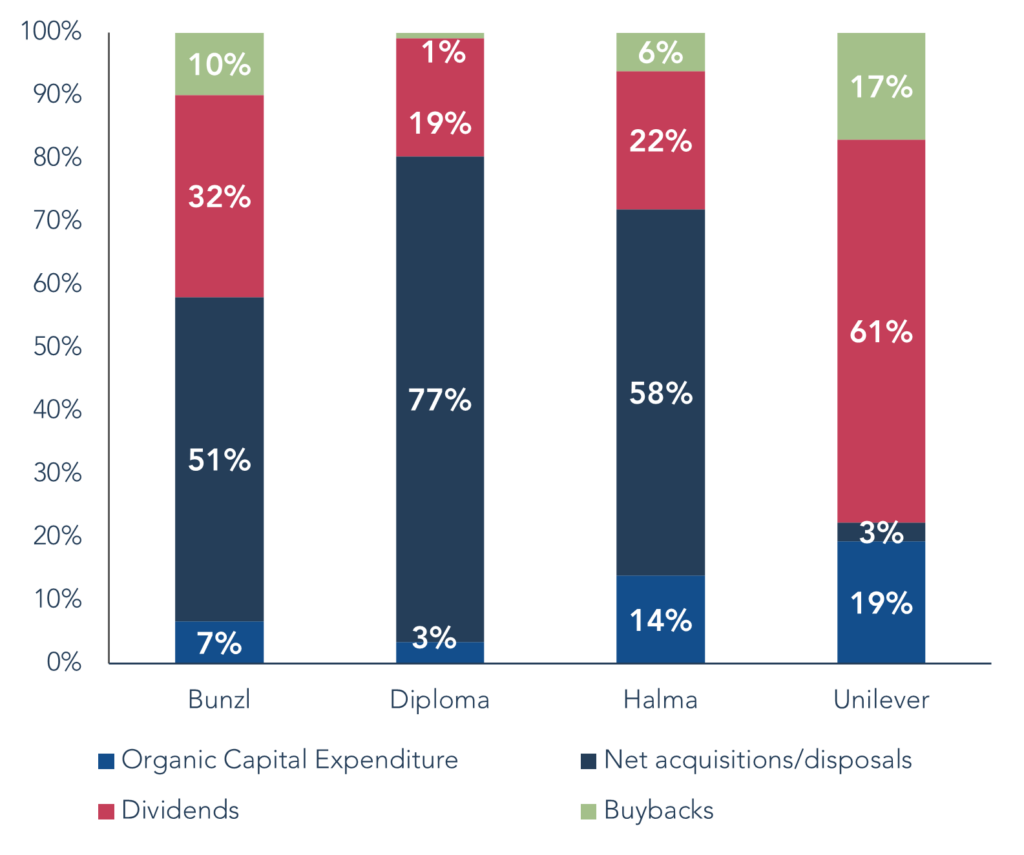

Bunzl, Diploma, and Halma are distinct in their ability to continually reinvest the majority of their excess cash into regular acquisitions, while maintaining attractive rates of return (and with their acquisitions earning higher returns than the ‘occasional’ acquirer). This offers a way to supercharge growth over and above organic sources and offers a compelling alternative to simply returning cash to shareholders.

PRIMARY USES OF CASH (LAST FIVE YEARS)

Source: Troy Asset Management Limited, 31 May 2024. The reference to specific securities is not intended as a recommendation to purchase or sell any investment.

What makes their approach successful and distinct from much of the M&A we see in the headlines? We highlight a few common themes:

Buying quality businesses.

This may sound obvious but is pivotal. Bunzl, Diploma, and Halma are not buying broken businesses – they are buying well-run, often family-owned and founder-led, small enterprises that are successful, profitable, and likely to keep performing well. It is not about the buyers thinking they can run it better or fixing a problem. It is about nurturing what is special about them, which generally entails retaining the existing management, employees, and strategy.

Buying at attractive valuations.

Many acquisitions fail to generate value simply because the buyer paid too much, even if the asset is good. Markets are competitive and filled with smart people so quality companies tend to rightly command premium prices. How can Bunzl, Diploma, and Halma buy successful businesses and still generate strong returns?

They buy small, private companies. By their very nature these are illiquid assets and may have some risks such as dependence on a small number of suppliers, customers or managers. Valuations are logically much lower than for large public companies, making return on your investment higher if they are successful. Interestingly, we note how stable the valuations for small private businesses have proven over decades – a key reason why Bunzl, Diploma, and Halma have generated strong returns for so long.

To give an example transaction, Diploma recently bought a leading industrial distributor of fasteners for c.£236m at a multiple of 7x expected operating profit, implying it will make c.£34m profit – a c.11% addition to Diploma’s existing business. This is an excellent starting point, suggesting a year-one pre-tax ROIC of over 14% (£34m divided by £236m). This is a highly compelling return in our view, both relative to Diploma’s own cost of capital and as an alternative to returning cash to shareholders. Many public company transactions occur at much richer multiples, creating more pressure to drive future growth or extract synergies to generate value for shareholders.

Acquisitions are modest and self-funded.

The vast majority of acquisitions by all three companies have been funded using their own internally generated free cash flow. Instead of needing to leverage up heavily or consistently issue equity, they have managed to buy companies every year with their own resources. They can do this because acquisitions are modest in size and valuation. And because all three companies grow well organically almost every year, generating a growing internal source of profits and cash to support purchases. We agree with one of Halma’s founders, David Barber, who noted in the 1990s that growth by this type of self-funded acquisition is in many ways closer to organic growth than to large-scale M&A. The small size also means that each transaction is low risk in the group context.

Decentralisation.

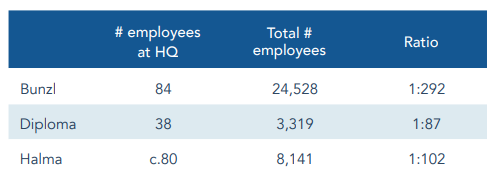

The table below highlights the small number of employees at ‘head office’ for our three companies. We think decentralisation is critical. Bunzl, Diploma, or Halma are not single entities – they are collections of many individual operating companies. Indeed, there is no customer-facing brand called ‘Halma’. Halma is c.50 companies covering different brands in different niches. Acquisitions of new companies are not made to extract synergies or be combined into a large central entity. They are bought to continue being run locally, with managers operating close to their customers and being incentivised directly on the growth of their own unit. Each operating company tends to have its own management team and P&L. Local managers will set and drive strategy – the top team at HQ understand that these people know their markets best and give them the operating leeway. Meanwhile, top management dedicate more time to capital allocation. This is distinct to many companies where CEOs are required to be talented capital allocators as well as excellent operations people.

Given this structure, what value does being part of the bigger group bring? Acquired companies have access to capital as part of a well-financed group, creating greater ability to invest and take risks. A parent like Halma is happy to provide capital for a portfolio company to try something that would be an existential risk as a standalone small business – for example, expanding to a new continent or investing into a risky new R&D project. HQ can also provide best practices and resources on functions such as IT, HR, and working capital management. They can facilitate shared learnings across the group – for example, one company connecting with another who has already gone through an expansion into a particular geography.

Culture, experience, and reputation.

Acquisitions are central to the culture and strategy of these companies alongside organic growth. They have accrued decades of learnings across hundreds of transactions and constructed dedicated teams for acquisition and integration. We think this is an underappreciated skill in comparison to the occasional purchaser. These companies build internal databases of hundreds or thousands of possible targets and cultivate relationships with owners/managers over many years. This reduces reliance on investment bankers in sourcing or deal-making. Reputation plays a pivotal role. Bunzl, Halma, and Diploma are established as indefinite owners of their assets, unlike most private equity funds which typically have a finite life of 5-7 years. They have long track records to demonstrate that acquired businesses can thrive and grow under their ownership. They have developed incentivisation structures that make sure acquired management teams can still share in future growth within the group. It is instructive to note Bunzl’s CEO himself joined the group through acquisition in the 1990s. The result is that these companies have become preferential buyers for many founders seeking the right home. In many cases, they are chosen even if they are not the highest bidder.

Considering the risks

Having run through some of the factors we attribute to their success, what are some of the key risks for these businesses beyond those that most companies face?

Can they keep growing?

A key reason that Bunzl, Diploma, and Halma have successfully acquired for growth is that they have large opportunity-sets – sectors with large, fragmented pools of small private businesses. Probably the most common pushback we hear is whether they can keep scaling – sourcing enough acquisitions to maintain attractive rates of growth. We are confident all three have significant depth of future opportunity. As an example, Diploma has almost zero revenue exposure to the entire continent of Asia. Acquisition targets are generally ‘SMEs’ – companies with 1-250 employees. SMEs account for 99.9% of all UK businesses, and the percentages are similar overseas. Growing in size does also mean scaling people and processes – something we have spoken at length about with all three companies.

In general, we think the market underestimates the duration of growth possible from these businesses. One nice feature is they can still grow (through acquisition) in tough economic periods when many companies are suffering organically. Sell-side analysts do not factor in acquisitions to their models until they are announced, meaning consensus estimates of future growth are almost always under-clubbed. We also take comfort from the much larger companies existing globally who are still able to regularly acquire – names such as Constellation Software (c.£46bn market cap) or Danaher (c.£150bn). Finally, seeing good organic growth is a vital sign of health for us – this generates the fuel for future acquisitions, and demonstrates these are good operating companies that continue to thrive under new ownership.

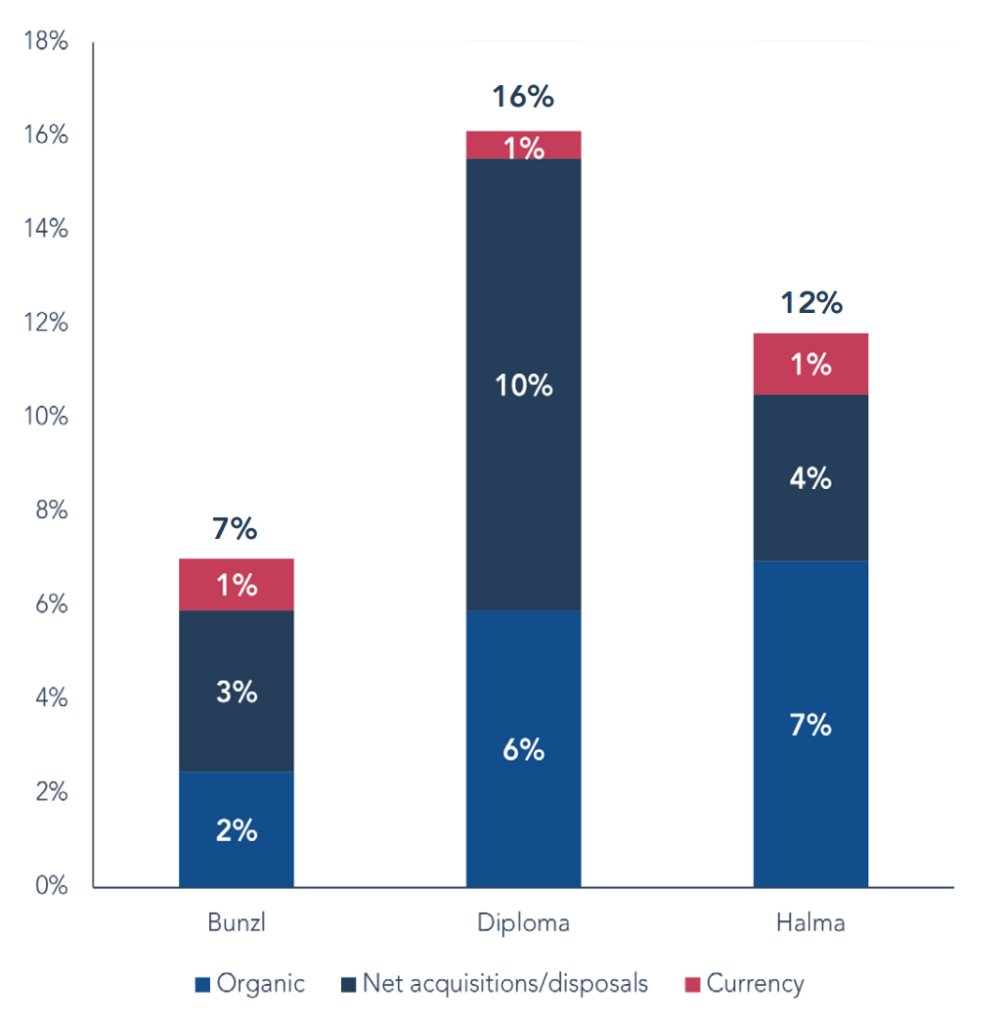

The chart below breaks down the components of the average revenue growth for each company over the past 10 years. These splits have been similar over longer time periods as well, highlighting how durable acquisitions have been as a source of growth.

10Y AVERAGE ANNUAL REVENUE GROWTH BY SOURCE

Source: Bloomberg, 31 May 2024. The reference to specific securities is not intended as a recommendation to purchase or sell any investment. Note, numbers may not sum due to rounding.

Change in capital allocation, messaging, or culture.

It is important for us to see consistency in acquisition execution and strategy. These companies have proven a formula that works and we look for continuity, even if top management changes. Warning signs could be higher acquisition multiples, entering materially different sectors, or talk about centralising or synergies. The top management teams of these companies need to be comfortable being ‘hands off’ – one CEO remarked to us the importance of being ‘low ego’ and having no desire for ‘empire building’. Relatedly, we note that each of the three companies has had only two CEOs over the past c.20 years5 – another positive reflection on their culture and quality.

Final thoughts

We hope for ongoing consistency and discipline from Bunzl, Diploma, and Halma. Their mix of organic and inorganic sources has led to highly defensive and reliable growth over many years. Halma recently achieved its 21st year of consecutive profit growth. All three have also been wonderful income growth stocks – Bunzl has managed 30 years of consecutive dividend growth, Diploma c.25, and Halma 45. The compound annual growth rates for their dividends over the past 20 years are 9%, 15%, and 7% respectively.

We know some investors query whether these companies should pay dividends at all rather than spending all their capital on acquisitions. From our perspective, we like the dividends – they instil discipline and create healthy competition for capital, ensuring management focus acquisition spend on the best opportunities. Many employees are also shareholders alongside long-term investors. The dividend enables them to realise some value from their holdings without selling shares. All three companies have sensible payout ratios of c.40% or less. In the case of Halma and Diploma, they tend to grow their dividends below the rate of earnings (and cash flow) growth – reducing the payout ratio each year and freeing up more capital for acquisitions while still increasing income.

In short, we think these are three special companies that encapsulate much of what we look for in investments at Troy, and what we consider the right type of income stock. Excepting our own future commentaries and newsletters, we hope they long remain un-newsworthy!

¹ FT Article: Index investing: Bad news bears, see also: FT Article: XFT index: it’s the quiet ones you gotta watch.

² McKinsey & Company: Perspectives on merger integration.

³ McKinsey & Company Quarterly.

4 In brief, an attractive ROIC means making healthy margins and using your capital spend efficiently.

5 We do exclude a short-lived CEO at Diploma who was in place for just four months in 2018.

Please refer to Troy’s Glossary of Investment terms here. Fund performance data provided is calculated net of fees with income reinvested unless stated otherwise. All performance and income data is in relation to the stated share class, performance of other share classes may differ. Past performance is not a guide to future performance. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The historic yield reflects distributions declared over the past twelve months as

a percentage of the fund’s price, as at the date shown. It does not include any preliminary charge and investors may be subject to tax on their distributions. Any reference to benchmarks are for comparative purposes only. Tax legislation and the levels of relief from taxation can change at any time. Any change in the tax status of a Fund or in tax legislation could affect the value of the investments held by the Fund or its ability to provide returns to its investors. The tax treatment of an investment, and any dividends received, will depend on the individual circumstances of the investor and may be subject to change in the future. The yield is not guaranteed and will fluctuate. Any objective will be treated as a target only and should not be considered as an assurance or guarantee of performance of the Fund or any part of it. The fund may use currency forward derivatives for the purpose of efficient portfolio management.

Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. Any decision to invest should be based on information contained in the prospectus, the relevant key investor information document and the latest report and accounts. The investment policy and process of the fund(s) may not be suitable for all investors. If you are in any doubt about whether the fund(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party.

The Fund is registered for distribution to the public in the UK but not in any other jurisdiction. The sub-funds are registered for distribution to professional investors only in Ireland. The distribution of certain share classes of the sub-funds of Trojan Investment Funds (“Shares”) in Switzerland is made exclusively to, and directed at, qualified investors (“Qualified Investors”), as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended, and its implementing ordinance. Qualified Investors can obtain a copy of the prospectus and the key information documents for Switzerland, the memorandum and articles of association, the latest annual and semi-annual report, and further information free of charge from the representative in Switzerland: Reyl & Cie Ltd, Rue du Rhône 4, CH-1204 Geneva, Switzerland, web: www.reyl.com. The Swiss paying agent is: Reyl & Cie Ltd, Rue du Rhône 4, CH-1204 Geneva, Switzerland. Certain sub-funds are registered in Singapore and the offer or invitation to subscribe for or purchase Shares in Singapore is an exempt offer made only: (i) to “institutional investors” (as defined in the Securities and Futures Act, pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore, as amended or modified (the “SFA”); (ii) to “relevant persons” (as defined in Section 305(5) of the SFA) pursuant to Section 305(1) of the SFA, and where applicable, the conditions specified in Regulation 3 of the Securities and Futures (Classes of Investors) Regulations 2018; (iii) to persons who meet the requirements of an offer made pursuant to Section 305(2) of the SFA; or (iv) pursuant to, and in accordance with the conditions of, any other applicable exemption provisions of the SFA.

All references to FTSE indices or data used in this presentation is © FTSE International Limited (“FTSE”) 2024. ‘FTSE ®’ is a trade mark of the London Stock Exchange Group companies and is used by FTSE under licence.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. Any fund described in this document is neither available nor offered in the USA or to U.S. Persons.

© Troy Asset Management Limited 2024.